Contact Intuit Corporate

Toll free phone number: 1-650-944-6000Intuit Inc. is a global financial software company headquartered in Mountain View, California, with offices worldwide. Intuit provides a wide range of financial management and tax preparation software solutions, including QuickBooks, TurboTax, and Mint. These products cater to individuals, small businesses, and accounting professionals, helping them simplify financial tasks, manage finances, and file taxes efficiently and accurately.

If you have a problem and need to contact Intuit complaints department, the best Intuit contact number to call would be toll free 1-650-944-6000 or contact Intuit support through email at BusinessServices@intuit.com. The best hours to reach the Intuit customer service number with a live agent are between 12am-12 pm hours [7 days a week] (all times are in EST).

The Intuit corporate office is located at 2600 Marine Way, Mountain View, CA 94043, United States with Intuit corporate number of 1-650-944-6000. Leaving your Intuit corporate office complaints below is a great way to have your voice heard.

The most common Intuit corporate complaints include concerns about the cost of their financial software products, such as QuickBooks. Users have reported difficulties in navigating the software and challenges in data migration. Some customers express frustration with customer support response times and the need for ongoing subscription fees for certain features. If you have a problem with service, a rude employee, or products please leave Intuit headquarters complaints we offer a convenient link to a complaint form here https://www.intuit.com/company/contact/

Do you have a customer complaint for Intuit? Let us know by clicking here and leaving a review.

Experienced poor service? File a complaint here!

Intuit Contact Information

Report complaints to corporate and get satisfactionIntuit headquarters address

- 2600 Marine Way

- Mountain View

- CA 94043

- United States

Company website

1-800 phone number

1-650-944-6000Support email address

support@intuit.comBetter Business Bureau rating

A-Customer service hours

12am-12 pm hours [7 days a week]

Browse reviews of other Software

- Equinox

(1 reviews)20 - Yellow Pages

(8 reviews)37.5 - ADP

(24 reviews)21.666666666667 - First Data Global Leasing

(2 reviews)20 - Kelley Blue Book

(6 reviews)36.666666666667 - Apple iTunes

(126 reviews)36.825396825397 - AFNI

(4 reviews)55 - Intelius

(12 reviews)33.333333333333 - Microsoft Skype

(32 reviews)44.375 - 3dcart

(2 reviews)80 - GoDaddy

(25 reviews)28.8 - Dashlane

(4 reviews)40

Top Intuit Complaints

Browse more than 36 reviews submitted so far

In October 2018, I was required to file and submit payment for quarterly state taxes. The payment was drawn from my account by Quicken and submitted to the state, but Quicken failed to submit the account information with it (as they have done in the past). My indication that the "ball" had been dropped was when I received notice from the state of my failure to pay the taxes. I contacted Quicken and, although difficult to work with, the representative claimed that all payments and documentation was submitted. I contacted my financial institution and confirmed that a draw and payment had been made to the state. I then contacted the state, and they tracked down the payment, but showed no associated paperwork being filed. That is where my compaint lies...

The present situation is that I've incurred late fees and penalties as a result of Quicken's failure to file the associated paperwork with the payment. After several rounds with Quicken "customer service", I've been unable to secure any acknowledgement or reimbursement of the penalty and fees I absorbed. The representitives are reluctant to forward me to higher corporate authority for resolution. As a result, I've cancelled my use of QuickBooks.

A quick books certified person Sharlene Mazza , she works out of parrish fl. calls her rip off over billing company Security financial solutions. She charged anglo American services , my company. $ 3269.50 for 1 month service at $ 45.00/hour. She charged a $ 1200.00 set up fee, for 44 customer entries in which anglo already had quick books for all current customers. She then billed and kept billing for all the work that should of been in the $ 1200.00 set up fee.

IF THIS LADY DOES NOT LOSE HER QUICK BOOKS LICENSE THIS IS A CRIME

jim schirtzinger

4928 thames ln Sarasota fl 34238

941 447 1296

I don't care if Turbo tax can get me a billion dollars back on my tax return.

I don't care if it becomes a law that every citizen has to use Turbo tax to file

their taxes. I will NEVER use Turbo tax to file my taxes EVER again.

We used TurboTax Deluxe to compute our taxes and then completed an extension request, as funds won't be available until August. By then, we may sell our remaining property and not have to declare ANY of the sale.

However, TurboTax would NOT efile the request because we owe AND it provided the IRS mailing address based on our getting a refund. If I hadn't followed up, Secret Service agents would have been after us for tax evasion.

Turbo Tax now providing unfinished software to consumers. Short of getting it directly from them at a substantially higher price, (of course completed program), or signing up with a public forum like CREDIT KARMA good luck. This is just one more failure on their part for customer service. It is little wonder that they are losing so many of their once loyal consumer base to other providers, they have lost the most meaningful corporate requirement: CUSTOMER SERVICE! Will be letting other's know about their failing products.

This complaint refers to the 2017 Turbotax Deluxe edition.

I zipped right through the process of completing my daughter's Federal and State returns. 5 stars so far. THEN it came time to e-file. Federal return went fine.

State return was a disaster. FIRST you upped the price from $20 to $25, THEN I got into the jungle of charging that overcharge to my credit card! There has to be some way to simplify that sign in process. Why do I have to establish an account just to give a simple payment ? And you had the guts to ask for another $39.95 if I wanted to deduct the $25 from the return !!

I feel you owe me at least a refund of the e-file amount, maybe the whole $44.95 I paid for the Deluxe CD.

My Sainted Grandmother is watching you. Beware

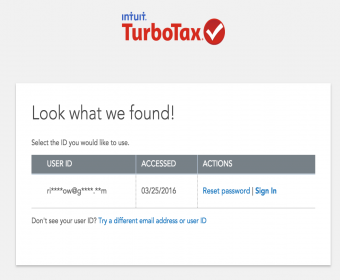

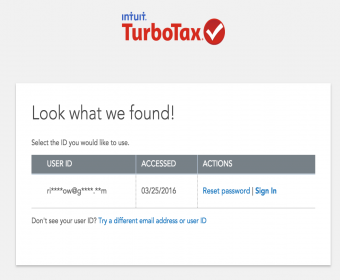

I requested my ID (request number 137674) be changed at sign in. It was denied. Not sure why. All I wanted to do was change my billing information and address. I must have spoken to at last six people who gave me different instructions, but I still cannot sign in to my account. Does Intuit customer service ever answer? I have spent over five hours trying to resolve a simple request. I would never treat my customers the way your company seems to do.

Every year Intuit corporate offices say lets raise the fee by 1,000 for no reason. The customer service number is terrible. Now they speak clear English but we have to pay more for that? And that doesn't include more payroll cost they hit you with during the year! Aka updates, what a way to ruin small business.

I'm on Quicken 2014 Deluxe and have just upgraded from Version 8 to 9. In attempting to update my files with the bank, I received a message that I needed a six-digit number to confirm my identity. I requested the number via email and to be returned via email. By the time I got the email and entered the number I received a msg. that it had expired. I tried it again today with the same results but timed the interval between the request and the receipt of the email.- 9 minutes. The result was the same - expired. I called support and connected after 54 minutes. The young lady (I did not get her name) was very patient and tried several things but to no avail. Bottom line I cannot update my files which means that Quicken is worthless to me until I can. The case number is 418562446.

Can't get through to anyone at Intuit customer service, after 20 minutes on the phone with the corporate office. I need to cancel my email account because I have a CPA currently doing this for me. I am going to have to go to the credit card company and put a block for any Intuit charges. I can't even believe I would have to resort to this.

I continued to get an error message from Intuit TurboTax when doing my final review. The system kept taking me back to a 1099R form ann stating that an amount must be entered. Since none of my 1099R forms did not contain any of that data, I went to the help button, community responses and no answers to the question......so then I called the 1-800 # for Intuit customer service. I was put on the eternal hold and finally after a 1/2 hr, someone answered. I went through the problem and they said they could not answer the call and that they would transfer to someone who could. another 1/2 hour on the phone and I get someone to answer and they literally did the same thing and transferred me again.......another 1/2 hour and no answer and I just hung up.

So three days later, I try again....that is today. I call in and I opted for the call back. I got a call surprisingly quick, 5-10 minutes, but explain the problem again and they give me the same answer, I don't know, I will transfer you....again I request call back. Again, I get a call back, repeat the cycle again......The last time I called the number again, waited for a call back and I got someone that was willing to TRY to help. He explained that he could answer questions for product support and that I needed to talk to the tax advice group.

I told him that I was pretty upset with the whole "HELP" system ater all that I just had gone through for the second time and I did want to be transferred to the phone system, but wanted him to find his supervisor to transfer me to so I could talk to another live body. He was patient, found his supervisor and transferred me to Jesse. Jesse assisted me by having me send the return to him to review, which he did while we were on the phone, saw the issue and again advised me that he would have to transfer me to Tax advice group. He stayed on the line until he confirmed that I was able to leave my number for call back......so now we wait!

So I will be blunt, this is the WORSE "customer assistance" system I have ever experienced. Intuit have wasted over 4 hours of my time just trying to resolve one question and we still do not have the answer. I strongly suggest that you personally try using your system and see how frustrating it is for us using it. TRULY, its ridiculous.

I am thankful that I had two people in the system that actually took the time to TRY to help, Jesse and the product support I talked with. But really, you need to update your systems, monitor call lengths, call completions and resolutions If you have a call center. Having a number that is basically useless and only available for those that can commit to getting an answer, which by the way I do not as of yet. How about staffing these call centers and with people that are able to answer the question!

My ticket number today, was 414871321 so you can see If you can follow the trail of terror we go through. The other one that consumed 1 1/2 hrs earlier this week was tossed in frustration, but I am sure you can find it by my phone number history.

I have attempted to resolve this issue on 3 different occasions without any solution to the problem. Burned up hours on the phone waiting for someone to answer form intuit support. I extract last years balance sheet and then attempt to drill down into the transactions that make up that balance. When I attempt to get the detailed transactions some times nothing comes back and occasionally I get parts and pieces of the transactions.

It is essential that I view last years transactions to ensure they are properly recorded by account type. I have 4 companies on quick books on line and this only happens with the company that has switched to new and greatest report format (as hyped by intuit). We need to resolve this quickly so I can proceed with information that will be used for tax return preparation.

I have been trying to change my email address on my Mint Bills account for over a week now. I can spoken with their customers service numerous times over the phone. I have sent them screenshot like they requested 2-3 times and they still can't figure it out. I find it that their customer service are having a hard time understanding my issues even though, it's very simple! very frustrating!

For the past 20 years or more, I have used TurboTax Basic with NO complaints. This year I first had trouble with the download. Then I was told that I needed to upgrade to the Deluxe edition to Itemize Deductions. Downloading the upgrade to Deluxe, they included the State software which I don't use and didn't want because I use the FREE PA Revenue website. I need a phone number to contact Intuit staff to discuss this issue. That's it! I'm done! Bye bye TurboTax!

The time of me being a loyal Turbo Tax customer for over 20 years has come to a complete stop and I will NEVER do business with them again. They removed three tax schedules from their Delux program that has always been there and are now charging EXTRA to use what was once part of the program. GOODBYE!!!

I used your software for years and never had a problem, until now. The first one was on the business expense the software told me to use the standard mileage when the actual expense would have given me a better deduction. I had to put the software into forms mode and do it manually. The second time I had a problem was with form 1040 line 10. I entered the amount and the software made 2 errors one on the State form line 40 estimated tax payments, I didn’t make any!

The second error was on Schedule A line 5a the software added the estimated tax to line 5a and made my return larger than what it was. I did an error check before I e-mailed it and the software said “No Errors” IRS caught the mistake and made the changes. I don’t trust turbo tax now.

Upon completing the tax inputs and paying for 2- state returns along with the federal, I cannot run copies of anything. One state return requires a hard copy mail in that I cannot get a copy of. I paid $39.00 for each state form that I cannot access. I waited 1.5 hours to discuss with a rep but was told I should just find a regular computer and not use a mobile device.. Very frustrating. A perfect example of why congress should simplify the tax code and eliminate the need for complicated tax filing.

I have used turbo tax for many years and until this year never had a complaint. However last summer I became a victim of a ponzi scheme. There is a straight forward procedure for filling out the supporting document, 2009-20 safe harbor, and including it with your 4684 in order to take a 95% deduction of the loses. However there is no way to make it work in turbo tax, and since I have relied on your product for so many years, this put me in a very uncomfortable bind.

I felt I had to file since time is so short, and now I am faced with getting help to file the appropriate forms for an amended return. This issue has cost me considerable stress as well as time and money. I feel like I was swindled by Turbo tax because i had already spent the money for the software and the filing before this was made known to me. Not only that but now in order to get the $1400 refund that is rightfully owed me by both the federal and state IRS, I must spend ever more time and money. If nothing else I may stop using turbo tax for that reason alone. At this point I am extremely disgusted.with millions of people affected this year alone, I think its time to step up and address this issue. No telling how much future business this one failure will cost.

After I finished my federal income tax form- i didn’t have to pay or get a refund-I started to do my state income taxes-it didn’t say they were charging me anything for the federal but did give me an amount for the state so I know I was going to pay for that-at the end of doing my taxes up pops up the federal income tax charge. I felt it was misleading. It should have said after finishing my federal income tax forms- it should have said the amount instead of thinking I didn’t have to pay anything.

I have been having problems with Turbo Tax for my 2012 IRS income taxes. It won’t show up on my screen at times and keeps freezing up. Aside from that I feel like there are other issues with it not finding discounts and tax write offs that can save me money.

Do you find that using a free service like Turbo Tax is actually more expensive than using H&R block or a more pricey tax company? Maybe it’s easier this way, or maybe I’m just lazy. Not sure but when I pay more and more each year in income taxes you have to wonder what’s going on.

I filed my taxes with Turbo Tax this year as I have for at least the last five years. No problem! The information that I filed on February 3, was accepted no February 5 AND according to Turbo Tax placed on a Visa debit card on February 24, 2011. That is just wonderful, except I NEVER RECEIVED A TURBO TAX DEBIT CARD, people! I have tried to call, and cannot get a HUMAN BEING on the phone, only recorded messages and not one of them addressing this problem.

I have sent email after email to their contact email address, only I GET NO RETURN RESPONSE! I called the bank and spoke to a lovely young lady who gave me all kinds of information, but told me the BANK DOES NOT ISSUE THE CARD, TURBO TAX DOES! I called to the IRS before I called the bank and that is how I got the bank’s number. It is so sad that the two people that I talked to do not work for Turbo Tax and yet, they were kind enough to offer all the help they could, while Turbo Tax does not even put a live person on their phone lines.

Even worse, I still do not have my refund and I still do not know how to get it. Okay, I still say it is a better deal than some preparers asking for huge fees, but I NEED MY CARD!!!

I got my card in the mail, activated it, got the iPhone app and waited for my return. It was deposited 2 days later, and I began happily spending my tax return! Well, here we are on the 4th day of using it. I’ve been using it all day and suddenly it gets rejected for an $8.00 charge!!! Ummmm, I have $1,280.00 on it. So I call them and get hung up on, so I call again and get hung up on again, so I call again…you get the picture. They reccomend (before the hang ups) to use the website for help. What does the website say? Call us. And the iPhone app says the same thing “call us!”. Seriously?!?!?

I’m about to rip my own hair out. I wish I’d never gotten this card. And from the other reviews it looks like when (or if) I finally get a hold of someone, they’ll be rude and unhelpful. Don’t make the same mistake I did. Stay away from this card!!!!! PS: I also got doubly charged for a transaction. Betcha anything I’m not getting that money back!!!!

You are going to love this one. I filed my state anfd federal tax returns with turbo tax online the federal return was accepted but the online state return is still pending according to them I called the state to find out they accepted it but turbo tax still says its pending. So yesterday I got my state refund but turbo tax still says its pending. I called turbo tax and was given the run around that they are only software company and if the state didn’t notify them that it was accepted it got nothing to do with them. Hoe can you trust a company like this.

Excuses they will give if someone has a problem they won’t stand up Some might say will you got your refund and yes I did. However turbo tax is doing a great injustice with this kind of talking. I’ll never use them again. I hope you consider using someone else too.

Beware new yorkers – for 4 years Turbo Tax was filing inaccurately nys returns – from 2006 to 2009 – piling up penalties and interest to the tune of 201.94. By the time i was getting nys notices it was too late to rectify the situation for the past years. Now i have to override the stupid program to put the numbers in the correct boxes – basically doing tt job for them, and last year when i efiled it wouldn’t go through and yet Turbo Tax charged my credit card and there was no way to get them to credit it – even though their online chat (don’t get me started on that). So i had to do a credit card dispute….

I have used turbo tax for 21 years. It has gotten more cumbersome each year but I figured I could blame congress and the office of the president. This year, however, turbo tax has even out done the government with it’s cumbersome, extremely difficult and very unfriendly w-2 preparation software. For that matter they have taken the software industry back at least 50 years. The software would kick me off the web right after I got logged in, locked up my computer and locked up my printer to the point where I had to delete and reload my printer drivers.

To add insult to injury they make it impossible to contact them. They probably figure that we complainers don’t make that much difference in their business. They way they are headed, I believe there eventually will be enough complainers to get their attention. I know in the future I’m going to let my buying other software do the talking. And for you folks at turbo tax if the other software is as lousy as yours I’ll do my taxes with a calculator.

Two years ago I bought a new computer from Walmart. I also bought a new Kodak printer primarily so I would have a local source for cartridges and other supplies. Now I am told by my local Walmart in Ballinger, Tx that they will no longer carry the Kodak 10b or 10c cartridges. If this is true I will never again buy major items from Walmart. In fact I am shopping for made in USA products and will not buy imported crap anymore if I have a choice. Shove it up your “made in china” and sit on it.

Just bought Turbo Tax from Costco for $49 bucks just a few days ago. Been using them for years with no complaints but this year BEWARE!!! Paid the $49 bucks and did my taxes tonight and guess what! They charged me another $19.95 to file my State returns over the internet. When I refused, they refused to file my federal returns except by mail. After screwing around with them for over an hour online my wife said just pay it! Okay I paid the $19.95 and started the process again and guess what? They wanted another fee of $29.95 for using another bank other than their own to recieve my refund.

Now this is an additional $50 bucks after you paid the $49 at Costco with no warning about the additional charges which you can’t escape. Warn your family and friends and in additions to the above, it took me 7hrs to complete the returns. Just Crazy! I don’t believe all the fees and extra payments that you have to pay just by using Turbo Tax 2011.

I was quoted a free federal return from Turbotax and instead was overcharged for it (I file EZ…did the same last year). Then $39.99 for state was the next quoted price for the federal return for 2011. Well I was charged $74.00, and I could not cancel order, and the fee was not finally disclosed until after payment was taken from me for 2011 federal income taxes. This service is a rip off, instead you should file directly with the IRS Efile if you can. I will definitely do that next year, any one know of a way for me to get my overpayment back from Turbotax?

Purchased Turbotax software @ Office Depot for my 2011 federal income taxes. This was supposed to be easy, or so I believed in the beginning? Options were vague and tedious, no direction. Difficulty locating rental property deductions, not to mention different types. “Premier” states product support just a phone call away, but doesn’t publish a phone number anywhere. You have to jump through hoops. Once you finally locate a number you go on a waiting list with them for customer support. You have to be joking. Do NOT buy this Turbotax software!

I have used Turbotax for years and years. The new 2011 version is a nightmare to use for preparing 1099’s. You have to sign in every time, and usually re-sign in while you are using it. Error message appears without giving you any explanation of how to fix the problem. You cannot print out all forms together, just a tedious one at a time pdf files, plus the forms have changed and you waste more paper than before. You cannot print your summary of all forms either. Transfer process from previous years records works and that is the only good thing about it. It still takes longer to fill in the forms. I will not efile my forms either as I do not trust their system for privacy.

On April 8, 2011 I send an email to turbotax to find out how much the software will cost me to do it online. Then I called them. I clearly told the guy I was talking to, I got a rental properties, which on is the best for me including the State. First He told me $49.99, and I said I will call other company to see if I can get it cheaper. The guy said, he will give it to me for $43.95, I can file unlimited federal and one state. I was agree to pay for it, at that time I gave him my debit card number over the phone, few minutes later I couldn’t download anything on my computer, so he transfer me to the turbotax support Department.

I spoke to Gopinath S concerning my issue he walk through it, then I started file my daughter income tax, as soon i get to the state part, Turbotax send me a message I have to pay an extra fee for the State because the state is not included. I got my receipt for everything, now I find out they charge me $44.98 instead $43.95. I hope you guys do something about it, because it’s not right what they doing. Lot of people trust them. On monday 4/11/11, when I call them, I spoke to Carline, she stated nothing they can do for me I have to pay extra $39.99 to get the State, other then that she will refund me my money. A few second later she gave me my refund number, and I will get my money on five business days.

I filed for my taxes on February of 2011 on the 20th. My filing for the taxes was to be taken out of Turbo then deposited into my checking. I did receive my State but I called and called the IRS about my Federal. Just received an email today FINALLY from the IRS that it will be deposited before April 19, 2011 into my checking. Turbo never took there money out they took it out of my checking which overdrew my account! Then I never received my Federal payment. Did not credit the checking at all! Now, I have to go down to my bank and cover the charges that Turbo Tax did not take out of my Federal payment! I will never do Turbo Tax again. When I get back I am going to call Turbo Tax and ask them WHY they did what they did!

Turbo tax just ripped me off, and there is nobody to recover my money from. They overcharged for my taxes today, right after I had finished and submitted the whole thing to them on their turbo tax website online. They are getting away with fraud in my opinion and I have no idea who to even complain to in this matter. I did not agree to be charge the amount they debited from my visa, and never authorized that much money coming out of my card. From what I’m finding out, this is a horrible company, and their turbo tax ad is even up on this website. Tell everyone you know to go elsewhere to do your taxes in 2011…it’s our only method to stop them!!!

I completed my 2011 turbo tax income tax returns, wanted to buy audit defence but the process keeps hanging in the air and not going through when I click the button. Also I find that I am unable to submit the completed return on their website. I remain connected to the internet, yet cannot submit using turbo tax on their website. I used the same computer that I have used for the past four years. It worked each time then, yet now it does not work. After trying over and over I am unable to reach customer service for up to two hours holding time. I just want to submit my 2011 tax return. Who can help ??

We used turbo tax online program to file our taxes this year, 2011. We used the direct deposit option requesting a visa credit card card and bank. There was a problem on turbo tax’s end with the direct deposit, so we were refunded the fee. We never received the card. We got an email with a confirmation number that card was on the way. We got an email saying that federal refund would be mailed to us. Never had any contact regarding state refund. Around 2-25-11 started contacting the state about our turbo tax refund. told would receive in mail within two weeks. Today, 3-24-11, I got in touch with a state refund customer rep. and was told our refund had been deposited on, 2-8-11.

And still we had no turbo tax card or any kind of contact from the company telling us what we needed to do, or find out if we received our refunds. Which would have been the right thing to do. I called the toll free number to find out about getting a card sooner than 7-10 business days and was told you would fedex one in 5-7 days. I insisted on an overnighted card. Said be here in 1-3 days. At the end was told would get the card on Wednsday, six days later. After figuring out turbo tax said six days I called back and was told 1-3 bussiness days. Their screw up cost us a lot of things.

A motorhome for a cost next to nothing, utility shut offs, which cost us deposits on top of other fees. We will never use this company again unless turbo tax ends up compensating us in some way. Turbo tax needs to instill some better customer service, such as, better communication when these errors happen. Follow up contact to make sure the customer has all the information needed to get their refund in a timely matter.

my turbo tax return is basic as i am a pensioner. ive used quick tax for years but this is the last time i will put up with these problems. i usually get the standard but being retired now i should only need the basic plan. every time i enter something turbo tax tells me i should update to standard. when some expenses such as medical expenses get input they immediately say upgrade to standard version. i will pick up tax forms and do it by hand next year and never again use this program to file my yearly federal income taxes.

I recently subscribed to the turbo tax with my tax refund. I used the refund credit card at several locations this is the worst card I ever had. My card was charged twice for the same item from a merchant, and even after placing several calls myself as well as the merchant still to date has not received any solutions. I will never use this service again from turbo tax and I will never recommend your service to any of my family and friends. It is just like pulling teeth to get someone that speaks good English to talk to you. I just want to deal with somebody from customer service who is not rude and who will not over talk you. Turbo tax customer service stinks.

I filed on a CD disc but file with you (TurboTax) every year. I had $1444.00 return coming (SS#XXX XX 3443), but was shorted between $80-90. I paid all of my fees and “chat” prior to filling with TurboTax. I have never had problems with any tax return services, especially in a year like this one I needed every single penny. Why was I shorted on my 2011 tax return?

Turbo Tax never even told me my 20111 return was rejected and all because of a pin issue. Not to mention the extra fees this year. Then, I log onto my account to find none of my 2010 tax information is there. Can not reach anyone at Turbo Tax! Very upset with them!

A quick books certified person Sharlene Mazza , she works out of parrish fl. calls her rip off over billing company Security financial solutions. She charged anglo American services , my company. $ 3269.50 for 1 month service at $ 45.00/hour. She charged a $ 1200.00 set up fee, for 44 customer entries in which anglo already had quick books for all current customers. She then billed and kept billing for all the work that should of been in the $ 1200.00 set up fee.

IF THIS LADY DOES NOT LOSE HER QUICK BOOKS LICENSE THIS IS A CRIME

jim schirtzinger

4928 thames ln Sarasota fl 34238

941 447 1296

I don't care if Turbo tax can get me a billion dollars back on my tax return.

I don't care if it becomes a law that every citizen has to use Turbo tax to file

their taxes. I will NEVER use Turbo tax to file my taxes EVER again.

We used TurboTax Deluxe to compute our taxes and then completed an extension request, as funds won't be available until August. By then, we may sell our remaining property and not have to declare ANY of the sale.

However, TurboTax would NOT efile the request because we owe AND it provided the IRS mailing address based on our getting a refund. If I hadn't followed up, Secret Service agents would have been after us for tax evasion.

Turbo Tax now providing unfinished software to consumers. Short of getting it directly from them at a substantially higher price, (of course completed program), or signing up with a public forum like CREDIT KARMA good luck. This is just one more failure on their part for customer service. It is little wonder that they are losing so many of their once loyal consumer base to other providers, they have lost the most meaningful corporate requirement: CUSTOMER SERVICE! Will be letting other's know about their failing products.

This complaint refers to the 2017 Turbotax Deluxe edition.

I zipped right through the process of completing my daughter's Federal and State returns. 5 stars so far. THEN it came time to e-file. Federal return went fine.

State return was a disaster. FIRST you upped the price from $20 to $25, THEN I got into the jungle of charging that overcharge to my credit card! There has to be some way to simplify that sign in process. Why do I have to establish an account just to give a simple payment ? And you had the guts to ask for another $39.95 if I wanted to deduct the $25 from the return !!

I feel you owe me at least a refund of the e-file amount, maybe the whole $44.95 I paid for the Deluxe CD.

My Sainted Grandmother is watching you. Beware

I requested my ID (request number 137674) be changed at sign in. It was denied. Not sure why. All I wanted to do was change my billing information and address. I must have spoken to at last six people who gave me different instructions, but I still cannot sign in to my account. Does Intuit customer service ever answer? I have spent over five hours trying to resolve a simple request. I would never treat my customers the way your company seems to do.

Every year Intuit corporate offices say lets raise the fee by 1,000 for no reason. The customer service number is terrible. Now they speak clear English but we have to pay more for that? And that doesn't include more payroll cost they hit you with during the year! Aka updates, what a way to ruin small business.

I'm on Quicken 2014 Deluxe and have just upgraded from Version 8 to 9. In attempting to update my files with the bank, I received a message that I needed a six-digit number to confirm my identity. I requested the number via email and to be returned via email. By the time I got the email and entered the number I received a msg. that it had expired. I tried it again today with the same results but timed the interval between the request and the receipt of the email.- 9 minutes. The result was the same - expired. I called support and connected after 54 minutes. The young lady (I did not get her name) was very patient and tried several things but to no avail. Bottom line I cannot update my files which means that Quicken is worthless to me until I can. The case number is 418562446.

Can't get through to anyone at Intuit customer service, after 20 minutes on the phone with the corporate office. I need to cancel my email account because I have a CPA currently doing this for me. I am going to have to go to the credit card company and put a block for any Intuit charges. I can't even believe I would have to resort to this.

I continued to get an error message from Intuit TurboTax when doing my final review. The system kept taking me back to a 1099R form ann stating that an amount must be entered. Since none of my 1099R forms did not contain any of that data, I went to the help button, community responses and no answers to the question......so then I called the 1-800 # for Intuit customer service. I was put on the eternal hold and finally after a 1/2 hr, someone answered. I went through the problem and they said they could not answer the call and that they would transfer to someone who could. another 1/2 hour on the phone and I get someone to answer and they literally did the same thing and transferred me again.......another 1/2 hour and no answer and I just hung up.

So three days later, I try again....that is today. I call in and I opted for the call back. I got a call surprisingly quick, 5-10 minutes, but explain the problem again and they give me the same answer, I don't know, I will transfer you....again I request call back. Again, I get a call back, repeat the cycle again......The last time I called the number again, waited for a call back and I got someone that was willing to TRY to help. He explained that he could answer questions for product support and that I needed to talk to the tax advice group.

I told him that I was pretty upset with the whole "HELP" system ater all that I just had gone through for the second time and I did want to be transferred to the phone system, but wanted him to find his supervisor to transfer me to so I could talk to another live body. He was patient, found his supervisor and transferred me to Jesse. Jesse assisted me by having me send the return to him to review, which he did while we were on the phone, saw the issue and again advised me that he would have to transfer me to Tax advice group. He stayed on the line until he confirmed that I was able to leave my number for call back......so now we wait!

So I will be blunt, this is the WORSE "customer assistance" system I have ever experienced. Intuit have wasted over 4 hours of my time just trying to resolve one question and we still do not have the answer. I strongly suggest that you personally try using your system and see how frustrating it is for us using it. TRULY, its ridiculous.

I am thankful that I had two people in the system that actually took the time to TRY to help, Jesse and the product support I talked with. But really, you need to update your systems, monitor call lengths, call completions and resolutions If you have a call center. Having a number that is basically useless and only available for those that can commit to getting an answer, which by the way I do not as of yet. How about staffing these call centers and with people that are able to answer the question!

My ticket number today, was 414871321 so you can see If you can follow the trail of terror we go through. The other one that consumed 1 1/2 hrs earlier this week was tossed in frustration, but I am sure you can find it by my phone number history.

I have attempted to resolve this issue on 3 different occasions without any solution to the problem. Burned up hours on the phone waiting for someone to answer form intuit support. I extract last years balance sheet and then attempt to drill down into the transactions that make up that balance. When I attempt to get the detailed transactions some times nothing comes back and occasionally I get parts and pieces of the transactions.

It is essential that I view last years transactions to ensure they are properly recorded by account type. I have 4 companies on quick books on line and this only happens with the company that has switched to new and greatest report format (as hyped by intuit). We need to resolve this quickly so I can proceed with information that will be used for tax return preparation.

I have been trying to change my email address on my Mint Bills account for over a week now. I can spoken with their customers service numerous times over the phone. I have sent them screenshot like they requested 2-3 times and they still can't figure it out. I find it that their customer service are having a hard time understanding my issues even though, it's very simple! very frustrating!

For the past 20 years or more, I have used TurboTax Basic with NO complaints. This year I first had trouble with the download. Then I was told that I needed to upgrade to the Deluxe edition to Itemize Deductions. Downloading the upgrade to Deluxe, they included the State software which I don't use and didn't want because I use the FREE PA Revenue website. I need a phone number to contact Intuit staff to discuss this issue. That's it! I'm done! Bye bye TurboTax!

The time of me being a loyal Turbo Tax customer for over 20 years has come to a complete stop and I will NEVER do business with them again. They removed three tax schedules from their Delux program that has always been there and are now charging EXTRA to use what was once part of the program. GOODBYE!!!

I used your software for years and never had a problem, until now. The first one was on the business expense the software told me to use the standard mileage when the actual expense would have given me a better deduction. I had to put the software into forms mode and do it manually. The second time I had a problem was with form 1040 line 10. I entered the amount and the software made 2 errors one on the State form line 40 estimated tax payments, I didn’t make any!

The second error was on Schedule A line 5a the software added the estimated tax to line 5a and made my return larger than what it was. I did an error check before I e-mailed it and the software said “No Errors” IRS caught the mistake and made the changes. I don’t trust turbo tax now.

Upon completing the tax inputs and paying for 2- state returns along with the federal, I cannot run copies of anything. One state return requires a hard copy mail in that I cannot get a copy of. I paid $39.00 for each state form that I cannot access. I waited 1.5 hours to discuss with a rep but was told I should just find a regular computer and not use a mobile device.. Very frustrating. A perfect example of why congress should simplify the tax code and eliminate the need for complicated tax filing.

I have used turbo tax for many years and until this year never had a complaint. However last summer I became a victim of a ponzi scheme. There is a straight forward procedure for filling out the supporting document, 2009-20 safe harbor, and including it with your 4684 in order to take a 95% deduction of the loses. However there is no way to make it work in turbo tax, and since I have relied on your product for so many years, this put me in a very uncomfortable bind.

I felt I had to file since time is so short, and now I am faced with getting help to file the appropriate forms for an amended return. This issue has cost me considerable stress as well as time and money. I feel like I was swindled by Turbo tax because i had already spent the money for the software and the filing before this was made known to me. Not only that but now in order to get the $1400 refund that is rightfully owed me by both the federal and state IRS, I must spend ever more time and money. If nothing else I may stop using turbo tax for that reason alone. At this point I am extremely disgusted.with millions of people affected this year alone, I think its time to step up and address this issue. No telling how much future business this one failure will cost.

After I finished my federal income tax form- i didn’t have to pay or get a refund-I started to do my state income taxes-it didn’t say they were charging me anything for the federal but did give me an amount for the state so I know I was going to pay for that-at the end of doing my taxes up pops up the federal income tax charge. I felt it was misleading. It should have said after finishing my federal income tax forms- it should have said the amount instead of thinking I didn’t have to pay anything.

I have been having problems with Turbo Tax for my 2012 IRS income taxes. It won’t show up on my screen at times and keeps freezing up. Aside from that I feel like there are other issues with it not finding discounts and tax write offs that can save me money.

Do you find that using a free service like Turbo Tax is actually more expensive than using H&R block or a more pricey tax company? Maybe it’s easier this way, or maybe I’m just lazy. Not sure but when I pay more and more each year in income taxes you have to wonder what’s going on.

I filed my taxes with Turbo Tax this year as I have for at least the last five years. No problem! The information that I filed on February 3, was accepted no February 5 AND according to Turbo Tax placed on a Visa debit card on February 24, 2011. That is just wonderful, except I NEVER RECEIVED A TURBO TAX DEBIT CARD, people! I have tried to call, and cannot get a HUMAN BEING on the phone, only recorded messages and not one of them addressing this problem.

I have sent email after email to their contact email address, only I GET NO RETURN RESPONSE! I called the bank and spoke to a lovely young lady who gave me all kinds of information, but told me the BANK DOES NOT ISSUE THE CARD, TURBO TAX DOES! I called to the IRS before I called the bank and that is how I got the bank’s number. It is so sad that the two people that I talked to do not work for Turbo Tax and yet, they were kind enough to offer all the help they could, while Turbo Tax does not even put a live person on their phone lines.

Even worse, I still do not have my refund and I still do not know how to get it. Okay, I still say it is a better deal than some preparers asking for huge fees, but I NEED MY CARD!!!

I got my card in the mail, activated it, got the iPhone app and waited for my return. It was deposited 2 days later, and I began happily spending my tax return! Well, here we are on the 4th day of using it. I’ve been using it all day and suddenly it gets rejected for an $8.00 charge!!! Ummmm, I have $1,280.00 on it. So I call them and get hung up on, so I call again and get hung up on again, so I call again…you get the picture. They reccomend (before the hang ups) to use the website for help. What does the website say? Call us. And the iPhone app says the same thing “call us!”. Seriously?!?!?

I’m about to rip my own hair out. I wish I’d never gotten this card. And from the other reviews it looks like when (or if) I finally get a hold of someone, they’ll be rude and unhelpful. Don’t make the same mistake I did. Stay away from this card!!!!! PS: I also got doubly charged for a transaction. Betcha anything I’m not getting that money back!!!!

You are going to love this one. I filed my state anfd federal tax returns with turbo tax online the federal return was accepted but the online state return is still pending according to them I called the state to find out they accepted it but turbo tax still says its pending. So yesterday I got my state refund but turbo tax still says its pending. I called turbo tax and was given the run around that they are only software company and if the state didn’t notify them that it was accepted it got nothing to do with them. Hoe can you trust a company like this.

Excuses they will give if someone has a problem they won’t stand up Some might say will you got your refund and yes I did. However turbo tax is doing a great injustice with this kind of talking. I’ll never use them again. I hope you consider using someone else too.

Beware new yorkers – for 4 years Turbo Tax was filing inaccurately nys returns – from 2006 to 2009 – piling up penalties and interest to the tune of 201.94. By the time i was getting nys notices it was too late to rectify the situation for the past years. Now i have to override the stupid program to put the numbers in the correct boxes – basically doing tt job for them, and last year when i efiled it wouldn’t go through and yet Turbo Tax charged my credit card and there was no way to get them to credit it – even though their online chat (don’t get me started on that). So i had to do a credit card dispute….

I have used turbo tax for 21 years. It has gotten more cumbersome each year but I figured I could blame congress and the office of the president. This year, however, turbo tax has even out done the government with it’s cumbersome, extremely difficult and very unfriendly w-2 preparation software. For that matter they have taken the software industry back at least 50 years. The software would kick me off the web right after I got logged in, locked up my computer and locked up my printer to the point where I had to delete and reload my printer drivers.

To add insult to injury they make it impossible to contact them. They probably figure that we complainers don’t make that much difference in their business. They way they are headed, I believe there eventually will be enough complainers to get their attention. I know in the future I’m going to let my buying other software do the talking. And for you folks at turbo tax if the other software is as lousy as yours I’ll do my taxes with a calculator.

Two years ago I bought a new computer from Walmart. I also bought a new Kodak printer primarily so I would have a local source for cartridges and other supplies. Now I am told by my local Walmart in Ballinger, Tx that they will no longer carry the Kodak 10b or 10c cartridges. If this is true I will never again buy major items from Walmart. In fact I am shopping for made in USA products and will not buy imported crap anymore if I have a choice. Shove it up your “made in china” and sit on it.

Just bought Turbo Tax from Costco for $49 bucks just a few days ago. Been using them for years with no complaints but this year BEWARE!!! Paid the $49 bucks and did my taxes tonight and guess what! They charged me another $19.95 to file my State returns over the internet. When I refused, they refused to file my federal returns except by mail. After screwing around with them for over an hour online my wife said just pay it! Okay I paid the $19.95 and started the process again and guess what? They wanted another fee of $29.95 for using another bank other than their own to recieve my refund.

Now this is an additional $50 bucks after you paid the $49 at Costco with no warning about the additional charges which you can’t escape. Warn your family and friends and in additions to the above, it took me 7hrs to complete the returns. Just Crazy! I don’t believe all the fees and extra payments that you have to pay just by using Turbo Tax 2011.

I was quoted a free federal return from Turbotax and instead was overcharged for it (I file EZ…did the same last year). Then $39.99 for state was the next quoted price for the federal return for 2011. Well I was charged $74.00, and I could not cancel order, and the fee was not finally disclosed until after payment was taken from me for 2011 federal income taxes. This service is a rip off, instead you should file directly with the IRS Efile if you can. I will definitely do that next year, any one know of a way for me to get my overpayment back from Turbotax?

Purchased Turbotax software @ Office Depot for my 2011 federal income taxes. This was supposed to be easy, or so I believed in the beginning? Options were vague and tedious, no direction. Difficulty locating rental property deductions, not to mention different types. “Premier” states product support just a phone call away, but doesn’t publish a phone number anywhere. You have to jump through hoops. Once you finally locate a number you go on a waiting list with them for customer support. You have to be joking. Do NOT buy this Turbotax software!

I have used Turbotax for years and years. The new 2011 version is a nightmare to use for preparing 1099’s. You have to sign in every time, and usually re-sign in while you are using it. Error message appears without giving you any explanation of how to fix the problem. You cannot print out all forms together, just a tedious one at a time pdf files, plus the forms have changed and you waste more paper than before. You cannot print your summary of all forms either. Transfer process from previous years records works and that is the only good thing about it. It still takes longer to fill in the forms. I will not efile my forms either as I do not trust their system for privacy.

On April 8, 2011 I send an email to turbotax to find out how much the software will cost me to do it online. Then I called them. I clearly told the guy I was talking to, I got a rental properties, which on is the best for me including the State. First He told me $49.99, and I said I will call other company to see if I can get it cheaper. The guy said, he will give it to me for $43.95, I can file unlimited federal and one state. I was agree to pay for it, at that time I gave him my debit card number over the phone, few minutes later I couldn’t download anything on my computer, so he transfer me to the turbotax support Department.

I spoke to Gopinath S concerning my issue he walk through it, then I started file my daughter income tax, as soon i get to the state part, Turbotax send me a message I have to pay an extra fee for the State because the state is not included. I got my receipt for everything, now I find out they charge me $44.98 instead $43.95. I hope you guys do something about it, because it’s not right what they doing. Lot of people trust them. On monday 4/11/11, when I call them, I spoke to Carline, she stated nothing they can do for me I have to pay extra $39.99 to get the State, other then that she will refund me my money. A few second later she gave me my refund number, and I will get my money on five business days.

I filed for my taxes on February of 2011 on the 20th. My filing for the taxes was to be taken out of Turbo then deposited into my checking. I did receive my State but I called and called the IRS about my Federal. Just received an email today FINALLY from the IRS that it will be deposited before April 19, 2011 into my checking. Turbo never took there money out they took it out of my checking which overdrew my account! Then I never received my Federal payment. Did not credit the checking at all! Now, I have to go down to my bank and cover the charges that Turbo Tax did not take out of my Federal payment! I will never do Turbo Tax again. When I get back I am going to call Turbo Tax and ask them WHY they did what they did!

Turbo tax just ripped me off, and there is nobody to recover my money from. They overcharged for my taxes today, right after I had finished and submitted the whole thing to them on their turbo tax website online. They are getting away with fraud in my opinion and I have no idea who to even complain to in this matter. I did not agree to be charge the amount they debited from my visa, and never authorized that much money coming out of my card. From what I’m finding out, this is a horrible company, and their turbo tax ad is even up on this website. Tell everyone you know to go elsewhere to do your taxes in 2011…it’s our only method to stop them!!!

I completed my 2011 turbo tax income tax returns, wanted to buy audit defence but the process keeps hanging in the air and not going through when I click the button. Also I find that I am unable to submit the completed return on their website. I remain connected to the internet, yet cannot submit using turbo tax on their website. I used the same computer that I have used for the past four years. It worked each time then, yet now it does not work. After trying over and over I am unable to reach customer service for up to two hours holding time. I just want to submit my 2011 tax return. Who can help ??

We used turbo tax online program to file our taxes this year, 2011. We used the direct deposit option requesting a visa credit card card and bank. There was a problem on turbo tax’s end with the direct deposit, so we were refunded the fee. We never received the card. We got an email with a confirmation number that card was on the way. We got an email saying that federal refund would be mailed to us. Never had any contact regarding state refund. Around 2-25-11 started contacting the state about our turbo tax refund. told would receive in mail within two weeks. Today, 3-24-11, I got in touch with a state refund customer rep. and was told our refund had been deposited on, 2-8-11.

And still we had no turbo tax card or any kind of contact from the company telling us what we needed to do, or find out if we received our refunds. Which would have been the right thing to do. I called the toll free number to find out about getting a card sooner than 7-10 business days and was told you would fedex one in 5-7 days. I insisted on an overnighted card. Said be here in 1-3 days. At the end was told would get the card on Wednsday, six days later. After figuring out turbo tax said six days I called back and was told 1-3 bussiness days. Their screw up cost us a lot of things.

A motorhome for a cost next to nothing, utility shut offs, which cost us deposits on top of other fees. We will never use this company again unless turbo tax ends up compensating us in some way. Turbo tax needs to instill some better customer service, such as, better communication when these errors happen. Follow up contact to make sure the customer has all the information needed to get their refund in a timely matter.

my turbo tax return is basic as i am a pensioner. ive used quick tax for years but this is the last time i will put up with these problems. i usually get the standard but being retired now i should only need the basic plan. every time i enter something turbo tax tells me i should update to standard. when some expenses such as medical expenses get input they immediately say upgrade to standard version. i will pick up tax forms and do it by hand next year and never again use this program to file my yearly federal income taxes.

I recently subscribed to the turbo tax with my tax refund. I used the refund credit card at several locations this is the worst card I ever had. My card was charged twice for the same item from a merchant, and even after placing several calls myself as well as the merchant still to date has not received any solutions. I will never use this service again from turbo tax and I will never recommend your service to any of my family and friends. It is just like pulling teeth to get someone that speaks good English to talk to you. I just want to deal with somebody from customer service who is not rude and who will not over talk you. Turbo tax customer service stinks.

I filed on a CD disc but file with you (TurboTax) every year. I had $1444.00 return coming (SS#XXX XX 3443), but was shorted between $80-90. I paid all of my fees and “chat” prior to filling with TurboTax. I have never had problems with any tax return services, especially in a year like this one I needed every single penny. Why was I shorted on my 2011 tax return?

Turbo Tax never even told me my 20111 return was rejected and all because of a pin issue. Not to mention the extra fees this year. Then, I log onto my account to find none of my 2010 tax information is there. Can not reach anyone at Turbo Tax! Very upset with them!

Have feedback for Intuit?

Thanks for your feedback!

Sorry. Please try again later!

Blog

Blog  Write for Us

Write for Us