Contact H&R Block Corporate

Toll free phone number: 1-800-472-5625H&R Block (www.hrblock.com) is a tax preparation company in the United States with offices in Canada, Australia, Brazil and India. It is publicly traded on the NYSE:HRB. There are 12,000 company-owned and franchise-owned branches in all 50 states and worldwide. Revenues in 2014 were reported at US 3 billion and there are over 80,000 H&R Block tax preparers (9,000 bilingual) that prepared over 24 million taxes last year.

If you need to report a problem with your tax return or service you may call 1-800-472-5625. You may also find support here. You may contact the H&R block corporate office and write to the CEO, William C. Cobb by postal mail using 1301 Main Street, Kansas City, MO 64105. The corporate headquarters phone number is 816-854-3000.

Founded in 1955 by brother Henry and Richard Bloch most Americans live within 5 minutes of an H&R Block office. H&R Block has prepared tax returns for over 650 million Americans since 1955 and they have branches located on military bases. Social media presence may be found at Facebook, Twitter, Linkedin and Google+ and their current slogan is ‘never settle for less’.

Experienced poor service? File a complaint here!

H&R Block Contact Information

Report complaints to corporate and get satisfactionH&R Block headquarters address

- 1301 Main Street

- Kansas City

- MO 64105

Company website

1-800 phone number

1-800-472-5625Support email address

support@hrblock.comBetter Business Bureau rating

A+

Customer service hours

24 hours a day

Browse reviews of other Financial Services

- TD Ameritrade

(17 reviews)40 - Lifelock

(7 reviews)34.285714285714 - CreditReport.com

(3 reviews)20 - Experian

(17 reviews)24.705882352941 - Equifax

(12 reviews)25 - TransUnion

(17 reviews)31.764705882353 - IC System

(2 reviews)40 - ABC Financial

(4 reviews)50 - Charles Schwab

(6 reviews)33.333333333333 - Scottrade

(3 reviews)46.666666666667 - Fidelity

(35 reviews)23.428571428571 - eTrade

(4 reviews)45

Top H&R Block Complaints

Browse more than 133 reviews submitted so far

Because of Covid-19.. the money..the HP block in Ontario cal.. oof of San Antonio and holt..well th

They had me put my W-2 in side envelope and take care of it. TfFile my taxes..well I got my edd check..and it said I never filed my taxes

I PURCHASE H&R BLOCK 2019 Deluxe Federal + State, and pay with my credit card ending 0678

for the price of $34.95, plus sale taxes $3.12 for a total of $38.07, they e-mail me my Activation code

EYJ8-Q8W8, plus a unlock code, with the instruction to reinstall the H&R Block 2019 back in my computer.

if was needed, Since my PC crashed, I need to reinstall H&R block 2019 Deluxe. Now they do not want to restored.

Stating that can't found those files, probably they think that with the crash, their confirmation e-mail was also gone.

but before that happen I printed their e-mails. which sending copy to their CEO William C. Cobb H&R Block Headquarter. in Kansas City.

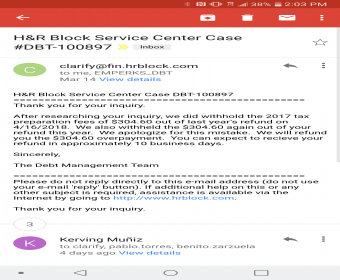

I did my taxes on your on-line program. I didn't file my State Tax's yet. Wanted to wait on them. So, I was looking at my bank statement and there was a withdraw from my bank account of $340 dollars from Comp of Dir Db Rad, which I had no idea what that was. I called my bank, and they reversed the 340 back to my account. They also said it was done by Bank of Amer by a company. So, all they could tell me, that it was State of MD. The date the money was taken out was 4/16,. I just got a letter in the bank this week, that said it was an unauthorized and processed incorrectly. They did find out that H&R Block took the money out of my account, and filed my State Tax's that I was never notified or authorized. They told me this is illegal to do. You had no right to file my State taxes without my permission. I'm speaking with my Lawyer now and seeing what we can do ,about what you did.

On our state tax we were qualified as a dependent (Addie) our daughter. The grocery tax was filed as an additional $100. It was denied. We brought it to the attention of your Moscow agent and subsequently it was refiled as an amended returned and denied. I expect the same result from the IRS. In addition all of the paperwork is being sent to my work address not my home. I don't see how your service could be worse. I expect a full refund of your fee as I couldn't have done any worse by myself. Steve

my tax was suspended called irs they never received it

r

I went to H&R Block on Denali in anchorage Ak

I went to walk back and ask for a bathroom and seen the manager Shannon loffer sniff drugs from off her desk with a straw.

I was shocked and never expected to see that in a tax office.

I didn’t say anything I just walked out and went somewhere else.

I have been going to HR block for several years for my taxes. This year has been the worst service that I have experience. I even paid an extra fee for HR block to help me with any problems we might have in the event we got audit or any additional information was needed. Well to my surprise we received a letter stating that they had received incomplete documentation and I need to send them my sons 1098-T form from school because it was not included in my tax returned. I attempted to reach the representative that help me but I was told that office was closed, I was redirected to an office within my area I was redirected to Luz at Figueroa office in Los Angeles, who I connect by e-mail and send her all my documentation, she assure me that she would take care of it. I waited over three weeks to follow up, I call Luz back because I had not received nor heard back from the IRS. I come to find out that Luz was on medical leave and no one from her office was following up on her cases. I made several attempts to speak with the manager, it took an additional three weeks for that Manager Maria to call me back I explain the situation, she said she review my case and that the proper documentation was re-sent and I would be receiving a letter from the IRS in a few weeks.

I did receive a letter stating that I was it was a Notice of Deficiency because I had not submitted the supporting documentation so therefore I needed to pay the amount owed. By this point I was so upset, I felt that HR block was not doing their job, but I wanted to proceed with still making use that HR provided the service that I paid for, I called 800 number again to try to reach Maria and I was told that the Figueroa office was not close and was re-directed to Pasadena office. This time I didn't not want to handle this by phone because to much time had passed and nothing was done by HR block. I made an appointment with Andy Rodriguez at 953 E.Colorado Blvd, He was very pleasant he re-assure me that he had been in this field for many years and knew how to handle taxes problems and would make sure that I would be taken care off. I called Andy a few weeks after to follow up, never received any documentation nor follow up from Andy, I was so disappointment with his service and lack of follow through.

So I called to complaint at 800 number and was told that I needed speak with another rep I schedule another walk in appointment with Nancy Chan took the letter I received and all the my paper work for my taxes. She had my husband and myself signed a form that we give her permission to speak with the IRS on our behalf so that she can get this miscommunication sort out. She sent me an e-mail stating that she spoke with the IRS on our behalf and she would be send the 1098-T copies to provide the supporting documentation. I waited four weeks and I called Nancy and was told that she would not returned back until January of 2020. So I called the IRS to follow up and I was told that Nancy did speak with them but no supporting documentation was ever sent. So here I am I started this process with HR block back in May when I received the letter and after speak with four representative in different offices, nothing was ever done to help the customer, who paid for their services and on top of that paid an extra fee for additional coverage. HR is providing false advertisement and had not provided what I paid for nor what they are putting out to the public.

I now have to take things in to my own and called IRS make copies of my 1098-T forms and write an appeal letter because HR block could not provided the service I paid for....

I'm a very unhappy consumer....

The sign clearly says this H&R block office opens at 9 on Tuesday's. It's 9:32 and the doors are locked and lights are out. I even took a picture of the office hours listed. It will not let upload the pic but I can send through my email if I need to.

I had a 1040 created 07/19/19. The tax Preparer is Cheryl M Zielinski. My Complaint is directed to “ Christine” who works with Cheryl. I do not have her last name or her Company title. Christine answers Phone and apparently is in charge of filing cabinet keys in which customer documents are kept. My initial encounter was an appointment I made 07/13/19 at 1003 Wolf Rd, Westchester,IL 60154 @Noon. I met with Cheryl, gave her my Tax information. We reviewed it. She said she “might” complete the return the same day and would Contact Me when return was completed. I received NO call from either Cheryl or Christine indicating tax return completion. On 07/16/19 I called 708-492-0557. This number connected me ONLY to an Office of the day-3802 S Harlem, Lyons,IL. I spoke to a Preparer, Jim who said he would try to send a message to Cheryl re: my request for my return. He gave me a corporate Tel# 800-472-5625.I spoke with Richard Coward who suggested I contact the Escalation Team@ 1-855-211-5334. The Case# 1635753 was created. On 07/18/19, Cheryl responded indicated my return was completed but I had to go to 74 E. North Ave, Villa Park, IL. An appointment for 07/19/19 was created. CHRISTINE was “yelling” in the background “make her come in today” I could not do that. Thus, the next day 07/19/19 Appt agreed. I told Cheryl I would be there between 10:00 -10:15 AM. I arrived at Villa Park location@ 10:05AM. Cheryl was there, opened door saying she was Waiting for Christine who had the Cabinet key in which my tax return was locked. Christine arrived about 10:26AM. She said hello to me and Immediately said she had Supposedly called me Saturday, 07/13/19 informing me of completed return. I Calmly explained, I received No Call, Message, Text Or email. Christine became violently ANGRY, Screaming at me that “ I WAS WRONG, she said she Had left a message at about 3:00 07/13/19 and that I had been TOLD to return to the Westchester Office when I dropped off my information. My response was that I received no message from her but was here now to pick up my return and may I please have it. Both Cheryl & Christine went to a Filing cabinet and Bantered with each other about the correct key and “how to open the cabinet. At this point, I was not optimistic about obtaining my return. They got the cabinet opened! BUT CHRISTINE BEGAN AGAIN, SCREAMING AT ME THAT I WAS WRONG TO FILE ANY Complaint. Cheryl had sat down at the desk and Christine came into the space Ranting, Raving, Screaming About my Complaints. Christine walked close to Cheryl across from where I was sitting. I began discussing the return with Cheryl and STILL, UNRELENTLESSLY, Christine was SCREAMING AT ME ABOUT 2 Feet from my face. I SAID, Please STOP and leave me Alone. Frankly, it was a Frightening encounter. Surprisingly, Cheryl did not even intervene or request that Cheryl cease her Unprofessional Behavior. Finally, Christine left the office. I briefly reviewed the return with Cheryl and gave her a $500 check made payable to H&RBlock. I have NEVER BEEN treated SO RUDELY in what should have been a Professional situation. Christine needs Anger Management instruction as well as professional ethical behavior instruction AMONG OTHER TRAINING. IT WAS DISGUSTING THAT A CLIENT WOULD BE SPOKEN TO SO VERY RUDELY. I was truly fearful that she was going to hit or grab me. I AM NOT EXAGGERATING!!! If I had been contacted, I would have picked up my Return earlier. I would like to speak with someone about this situation and know how Christine will be Reprimanded. Toni Rickards- 630-414-8862.

H&R Block did not have my back. The fine print on their 'guarantee' renders it useless. If you want Peace of Mind, I recommend you choose another tax preparer. My only recourse at this point is to complain on social media.

My husband and I went to H&R Block to prepare our 2017 income tax return. Our appointment was on February 28, 2018 with Sharon Resler. She seemed uncertain of what she was doing and called a CPA several times during the appointment to ask questions about how to prepare the taxes. We told her multiple times that we had sold a house in 2017 as a contract for deed sale. The paperwork was finished and we purchased the Peace of Mind guarantee. We had no reason to doubt their work was accurate.

Fast forward to April 2019... we chose a hometown CPA (Phillips Tax Service) to help us prepare our 2018 income tax return. We originally had an appointment in March, but they had to cancel it and rescheduled us for Friday afternoon, April 12. At that time, we were asked questions about the contract for deed sale of the house and discovered that H&R Block did not file the correct forms on our 2017 return. In order to prepare the 2018 tax return, Phillips Tax Service first had to fix the 2017 return, which they did for an additional fee. We also had to return to Phillips the next day, Saturday, April 13 to finish the process. We went to H&R Block on Monday, April 15 to request a refund of the fees we paid for their bad tax filing, and to request reimbursement for the additional fees that were charged to fix their mistake.

Ultimately, we had overpaid over $700 on our 2017 taxes due to H&R Block's errors. They charged us $490 for the bad filing, and then we were charged $250 for the amendment. H&R Block responded to our claim for reimbursement with a letter that our claim was denied because:

"H&R Block was not notified within 60 days", and we "failed to allow H&R Block to assist". Also the letter stated that we did not provide the correct information when our return was being prepared, which was absolutely not true. We told them *multiple* times that we had sold a house as a contract for deed sale. The H&R Block preparer even called another person to ask which forms to file in that situation, yet they still filed it incorrectly.

We had no reason to question the quality of H&R Block's work on our 2017 taxes until April 2019, when we tried to prepare our 2018 tax return. Upon discovery of their error, we went to H&R Block on the next business day to report the problem. That day was April 15. Did they really have time to fix the problem? They already totally screwed it up once, so we had no confidence that they could or would fix it correctly. And finally, their statement that we gave them bad information is absolutely incorrect.

Not only did their error cost me time, energy, and money, they provided horrible customer service all the way around.

Can H&R Block please confirm that your tax return software system DOES/CAN NOT track who goes into a return and when?

Can I please get a reply to this?

Thanx a mil, Mike

We were audited for our 2016 return. I was under medical care and forgot to include a W2. The IRS waited for two years to notify us. We have been run around forever by the IRS and finally went back to HR Block. I had filed our return online. My husband took a day off from work and took everything we had to an HR Block office in Gainesville, GA. The "tax professional" was over 30 minutes late, got there and had forgotten the keys, left, went home, came back - so unprofessional. Then she kept my husband there, typing with one finger, trying to work on our taxes - while he waited! Finally, he left, she promised our taxes by Tuesday (this was a Thursday). Friday evening she called with 'good news'! They owe YOU $5000. Yay, rah, all that. Said our taxes had been delayed but we could pick them up on Tuesday of the next week. Monday, she called again - oops there was a glitch in the system you owe them $3000. By this time our nerves are shot, we are flipping out and her only response was to repeatedly apologize and tell us to be glad we didn't have to pay the original $8000. This is now Friday, and I am still waiting to hear if our taxes are done. We are so concerned over this shoddy behavior that we are going to tax the return to a CPA to make sure this one is correct. This has been a nightmare all the way around. I wish I could remember why I used HR Block, we were always Turbotax customers and never had a problem. Never again - these are not tax professionals, these are people who take a class once a year.

They do not honor what they say if it's their mistake that you not pay I have to wait 90 days because somebody's up f****** more on there

Our preparer made a mistake on his end that has delayed our refund and we had to file additional paperwork and fix his mistake on our own and contact the IRS several times. No ones is helping us at a local level and the District Manager will not respond, we are requesting our filing fee back since the mistakes was the preparers fault and we had to make all corrections. Jennifer McGahee 912-604-4240 jenn12479@gmail.com

Poorly trained, cannot answer about filing a 4868 as a US Citizen overseas. The last online person Edwin N just deleted the conversation because of his bad information. I do not blame the service people, I blame a lack of training and that HR Block's link from the IRS website is misleading.

I went to you office in People's Plaza in Newark DE to have my taxes prepared. Afterwards I proceeded to pay the lady at the front desk for having my 2017 taxes prepared, she had me to swipe my Discover Card several times telling me each time that my card was decline. She voided a partial payment of the transaction which was a personal check for $100.00. The total was $387.00. Well, come to find out after we place a call to discover, we were told that there was a pending hold on my Discover Card for $287.00 from H&R Block. I was told by the cashier @ H&R block there was nothing she could do but to void the check and that I would need to wait for the hold to fall off my discover card. Now I'm out of $287.00 and no Taxes :(

My 2017 taxes where probably miscalculated by my regular accountant (who I like ;and would never wanna cause him any problems.I was notified by the IRS that I owed them 3,352 which includes a penalty of 206 dollars.So I contacted H&R Block and set up an appointment where an accountant told me it looks like someone took part of my RR retirement form from what I submitted by showing me that a staple was removed from the forms.So now I called the RR retirement board and received the missing forms ( which scares me because I cannot figure out where that form is or in who’s hands) Now I set up a second appointment and was informed that not only that they are not responsible for the late fees but they might also charge me to correct it

If this is H&H policy after 15 years of using you guys with the illusion of you guys backing your work has not only vanished but also is not a policy to keep your clients.

Not only do I feel disappointed in you guys for what I thought you where.

While getting my taxes done it was recommended I bring in paystubs to correct with holdings. Got the “runaround” multiple weeks until office closed for season. Contacted another office who supposedly had my information they asked to call me back and have not heard anything and that was a month ago. Very disappointed! I plan to change service after years!

I came to h&r block to file my late husband's taxes. He passed away in November 2017. His 2017 taxes were filed and processed. I recieved tax slips for his estate for 2018. I brought them to h@r block. I was told that his taxes needed to be adjusted. I paid a fee of $35.00 in March. They said they would adjust everything for me. At this current date nothing has been filed. I have repeatedly come to the office to get this resolved but to no avail. His tax forms cannot be found and I can't close his file. Nobody has any idea as to where my husband's file is. I'm at a stand still. My husband's name is Leonard Linden Wylie. His social insurance number is 635 400 559. Please help me resolve this as it's very difficult for me to continue this. I need closure.

Myself and my daughters was filing. I was filing head of household claiming them also but they get their own return as well. Madison Holbert was filed wrong they did hers as head of household causing them to not except mine so they all had to be amended and I also had to pay Madison‘s return back and I’m still waiting on mine to be amended and I filed at the end of January on beginning of February but yet they are still charging me for doing my taxes although it’s been a complete disaster. Very unsatisfied as I still wait for my money

I will never be using this service again. I had a simple tax return I filed jointly with my spouse and I find out that the tax preparer did not file the 10-95A form for my spouse and her child. I called in to the toll free number and was told I needed to make an appt. Three days later I take off work along with my wife who does the same go to the tax office to be sat in front of a woman who speak severally broken English who proceeds to give me a post it note with a 800 number for the health market place that I can find online like any other person with Google and any type of IQ. So I let this go. I proceed to spend 4 hours on the phone with IRS HnR block and the marketplace figuring out that it was paperwork that we had brought when we filed originally. Now I'm mad. Set up an appt. With a call back because no office appt. Available. Noone calls for the appt. I call in to the office they answer and take a message for the lady that did my taxes. She set up an appt. For me to have her call around 2-4pm. Noone called. I spend another hour and a half on the phone to be told they can not cancel someone else's appt. To make me one for tomorrow.(Even though this was done to me twice now.) I will have to wait till Friday now..... I am beyond pissed I spent alot of money in the past 5 years for this company to do my taxes. Now they messed up and won't do anything to fix it ......Wow your customer service is horrible and you have no loyalty to hard working honest PAYING clients then you know where you can shove it.By the way I also payed for this peace of mind scam they got and what peace of mind would you have when your now days away from the deadline to get this info in and the people already paid to do it don't care....peace of mind my ass for you maybe.

I am working on 3rd amended filing with the H & R Block. Now money is owed to the IRS. This is all the on the people at H & R Block that made these mistakes. I did pay for piece of mind! Now I was on the phone with your complaint department and they transferred me to the survey. How can I speak to someone that can help me? I will be happy to speak to someone about this matter. Please call me at 303-961-2233. I will be happy to send my file to someone.

What kind of company are you?

Help

Ediana Bjerser

Linda at H&R in Fountain inn, made an error on our 2016 return. We hired a better act. After being audited $8500.00. He found her mistake and was able to save us this money. I tried to resolve with her prior to talking to another acct. she said she put down what we told her. The problem error was in her figuring of our per dium. I’m requesting you pay us back the $1275.00 we paid the acct. that straightened her mistake up. By the way, they owe us money! Linda’s mistake cost us 1275.00 plus a lot of lost sleep! 864-498-3656

I have been an H&R Block software customer for 19 years. I have had many problems with my purchased software program this year and i had called customer support several times, trying to finish one last return and to use one of my 5 free e-files. i had a problem when i first downloaded my program with the activation. i called support and they sent me another activation code. I did several returns using 3 of the free e-files. When I was working on 1 last return, the program would not save my return and it would not let me e-file. I called and I was sent another activation code but had trouble with that as well. i called one more time and the customer support lady was very rude and told me that I had wasted many man hours of their time and unless I was going to get a new computer they couldn't help me anymore. Until that time i hadn't considered that it was a problem with my computer; I think she could have suggested that to me kindly. She was nasty, sarcastic and truly an example of the worst customer service I have ever encountered.

If I hear from someone at H&R Block, I may continue to purchase their product in the future. Otherwise i will be switching to Turbotax.

I filed my taxes and still have not received them however HR block has received full payment and has done absolutely nothing to assist me receiving my return. John lepley won't even return my calls or emails and the ladies in the office are extremely rude there seems no one will help me with my money, when I call the IRS or the helpline for HR block all they can tell me is that my money has already been deposited on March 13th which the bank that it got deposited to is that of h&R block.

Filed my 2017 taxes with H&R Block that was never filed paid 169.97 ( transaction # 5236721701016724603090),Order (A76F9DH8CAG64CA3) never received email or text stating the 2017 taxes were rejected. I did not know this until I filed 2018 taxes and they were also rejected I could not understand why? So I requested my transcripts from the IRS (4/22/2019) I received a letter that stated I did not file my 2017 taxes. So I called (209-951-7147) set up appointment on Saturday, May 4. 2019 at 9:00 am at H&R block on 315 West Main, El Cajon, CA ( confirmation# 319938782). The dark haired woman never introduce herself to me, just asked if she could help me, I told her my problem, she said that's what happens when you don't come in. Had me take a seat in her office, put my information in the computer and said yeah, your taxes were rejected, you did not receive any email or text. I said no (I would have taken care of it already). I asked about being penalized, she said you owe so not paying and filing late about 600.00 dollars like . And when I mail in my 2017 taxes to leave the preparer's name off. You can bring in the receipt and maybe you will get a reimbursement. I'm very disappointed in the service and lack of understanding by the person who seem to help but really didn't want too. I'm stressed and not sleeping over this situation.

Thank You

Allison Chavez

I was charged 656$ for filing my taxes.

I wasn’t good and was intimidated by the whole process so I went to H&R Block bc in the past they helped me so much!!! And I never had to pay 656$ So I trusted them.

I not only was charged 656$ for the services I also owed more money to the state and government than I ever had to before without getting anything back. I found it weird but like I said I didn’t know how to file my own and how it went so I believed the women who helped me.

I decided I would do my own taxes this year bc I was low on money as it was. I used turbo tax and used paper work from my 2017 year to help me through the whole process. What I found was really annoying bc there were things that could have applied to lower the price of what I would owed the government.

I paid TurboTax 189$ to file everything.

I owed the government 225$ and nothing to the state But my return from state was 250$

My income went up by 5000$ from the previous year and there wasn’t anything different as to my deductibles and how my lifestyle was.

So I’m the end I lost 1000s if dollars to a company I trusted. I paid h&r more money I paid the government...that isn’t normal and ridiculous. I wasn’t told the price until the end and so what could I do. Say no. No that would be inappropriate and rude. But I should have been told the price from the beginning. I told the women who I filed with that I had never had to pay that much or anything close to that in the past and she just shrugged her shoulders and said well that can’t be true.....

In February 2019, I filed my taxes with H & R Block located on Winchester Road and I-385. My tax preparer's name was Dedra, (901) 292-6130. She told me I owed IRS $550.00. I paid them this amount. She didn't tell me about the entire amount. I went to IRS and found out that I owe them a balance of $338.95.This was for failure to file taxes, penalties and failure to pay taxes. When she completed my taxes, she told me the total amount I owed H & R Block for their services was $159.00. I gave her $200.00 cash. She gave me $100.00 back and told me to keep quiet because there was another lady at the front desk. She immediately rushed me out of the door without a receipt. When I got in the car, I called the police station and told the officer what happened. He asked me did she give me all of my paperwork. I said, "yes." He said, "well don't worry about it." I went back to the same H & R Block on April 26,2019 to file 2017 taxes. When the preparer finished and gave me a receipt, he told me that the system was showing that I still owe H&R Block $159.00 for their services rendered for filing my taxes for 2016. I explained what happened and told him I was filing a complaint against Ms. Dedra. I spoke to a police supervisor on Monday, April 29, 2019, he told me to file a complaint with H&R Block. I returned to H&R Block on Tuesday, April 30, 2019 and asked for a complaint form. I spoke to Vanesa, tax rep. on the front desk. She told me they didn't have complaint forms and she didn't know how a customer could file a complaint because they have never had any complaints. I asked for the manager's name and phone number. She said they have a District Manager named Mark. She refused to give me his telephone number but told me she would send him an email and ask him to call me for an appointment ASAP! I have not heard from him. I am complainting because I do not trust her. She had access to my social security number as well as all of my personal information. If she did this to me, she did it to others. I plan to complaint to the Better Business Bureau. H&R Block failed to protect me as a normal customer. I thought she was giving me a special discount because I always use their services. Instead, she cheated me. This is theft.and dishonest. I am not happy with the services given to me by H&R Block. I feel as though the workers were trying to protect their coworker by not providing the telephone number to the manager. He should be made aware of what is going on. For questions, please feel free to contact me at (901) 679-0551.

I visited the location at 148 West Drive,Brampton on February 23/19 to have my tax return done. My refund was calculated at $11,700.00 and the lady doing my tax questioned if I will be getting a ck from CRA or direct deposit, at the time I did not pay attention to her questions, but she told me a few times don't look for the money until July or August. On April 4/19 I received a letter from CRA dated March 28/19 that they had reassert my tax return and the refund is now $11,900.00 and money will be deposited to the account on file. On April 5/19 I called CRA to ask when will I get the money into my account. CRA then told me the deposit was already done, I explained to them I never received the deposit and asked to confirm my account and was told on March 20/19 I called and changed my banking information from a Scotia bank to a CIBC account,which I never did. I questioned CRA how can they let just anyone gain access to my account then CRA said the person calling had all my information. Anyone who ever called CRA knows they ask the usual questions your SIN#,date of birth, address, in addition they ask who did your returns, where did you work for the filing year, what is your filing year gross earnings, what is on Line 404 of your return and what is the refund stated on your return. As the CRA agent said only myself and H&R Block knows this information. Immidately CRA placed a trace on the funds and strted an investigation they also advised my to make a police report claiming fraud which I did. I also went to H & R Block at 148 West Drive and met with the manager and told him about everything. He was rude and asked me to leave which I did. I then called and left many messages asking him to please call me but he never called me. I have how met with my lawyer and will be contacting H&R Block with fraud, identity theft, theft of my tax refund, stress and anything else I could charge them with. Everyone must be very careful as only H&R block knew how much I was getting and all the answere to the questions to go pass security, one must think with all the personnel information they have on the public the staff can take out credit cards, loans basically do anything with the information from the public

I am hot at all happy with this company and will take full pleasure in letting everyone know what happened, I will be contacting every radio station, tv news and YouTube. This is very unaccepted

Went to have four years taxes done and payed 510.00 for tax preparation and the IRS said two of years was off miss. Dont have your taxes done in Redwood city off people getting your tax wrong. 6mouths of delays.

I had my taxes one for $230. i was told my newly purchased home as well as other thinks like local taxes were irrelevant to my file. My return claim was filed, and denied over night. it was explained to my by the preparer that i was to come in and sign off, so I looked for help else ware!! A personal preparer told me to ask for my documents, and a refund, and to never go back. I called my local Madison OH. office ware I had done my prep and asked for a refund. After a ridiculous arguing match w a preparer the manager came on the line. He insisted i sign off on his return and file. I refused and demanded a refund. he said Fine!! and slammed down the phone. I called back to no reply... An hour later the manager called me stating a refund would be mailed if I return the H&R packet I left with. The office has since been closed! No one has reached me! NO check has arrived!

I would like to file a complaint against my tax preparer. First off I didn't get the person I was scheduled with, second she left the office twice to go chat with other customers, third i was there for 1.5 hours, fourth she hollered out her office door as I was leaving, in front of all the other customers, don't be surprised when it costs you $500, fifth I didn't get any phone call or email stating that she was as going to file an extension, even after I asked her if she would get them in on time or if I should just enter it in myself, sixth my taxes are still not done 4/28/19. I'm very disappointed in the service I once thought was great, i have been doing my own taxes the past few years and this year i had other deadlines to meet so i panicked to get them in on time. I don't even want her doing my taxes I rather just take them back to do them myself. Tax specialist Gin Marking out of Waunakee is not the person to go to if you want up front pricing and on time filing!

Well let's say I was supposed to get 187 back and I told them to take your 55 out that she told me she was going to charge me no not that I not only get no money you said that you put money in my account which is a lie and you try to say you sent me a check another f****** line thank you for f****** me for my 187 f*** you and the horse you rode in on n***** f****** service never not even a point one f****** rating f*** you and I hope you choke on it

This not a complaint as much as a question.

My Wi state return that H&R figured was different than what the state figured. The state calculated my taxable income was $1590.00 more causing my return to be $113.00 less than what H&R block calculated. I would like to know what would cause this. This caused my return to take a month and a half to be deposited into my checking.

If you need to see what the state figured and what your software figured I can copy and send to you .

Thanks

Barb Lawrence

Block accountant, Nancy Wang, did not discuss or explain charges ($900+) and did not make all deductions allowed including One Time Homeowner’s Sales Exemption. Paid several thousand state & federal taxes, no explanation and incorrect personal address (corrected after filing).

IRS. $24,543.00 paid

CA. 8,524.00. “

HI. 2,051.00. “

Ms Wang has made herself unavailable.

559 38 3851

Stuart Read

801 So. King. St #4110

Honolulu, HI 96823

Cancelled your FEE PAYMENT, will reauthorized after full review of this unacceptable reporting and is corrected.

Thank you

We got our taxes on an emerald card and when checking the balance recording said $350.00 available. We of course accepted this thinking it was part of our return. Turns out this was a predatory loan at 36% interest. This was not stated when we where told we had a balance on the card. I consider this fraud and predatory lending. I will be contacting the states attorney general's office and the better business bureau. H and R block whom I have used for 20 years for taxes and have been getting an advance since it has been available for Christmas for my kids has lost a long time loyal customer. I will tell everyone I know and post on Facebook do not use their services they are loan sharks.

Tax preparer was James Rouse out of Flint office on Dort Hwy and Court Street. First appt. I waited 30 min due to some confusion with computer system. Then a 5 min call was taken during my session after already waiting 30 min. I told Mr Rouse I'd be filing W2 along with home heating credit. He failed to inform me that everything must be sent all at once. My W2 was lost. Had to file amendment. IRS is now requesting further info concerning heating credit. Still have no idea when I'll receive a dime! Office I went to is only open for 45 min appt slot so can't even go back for help. Mr Rouse needs to retire. Inept doesn't begin to describe the horrible service he provided me!!

I have been trying to contact since March 28th 2019. I was told my IRS payment could be made through my bank account information and would show that it was withdrawn in 1 to 3 business days. I had my taxes done March 25,2019 and have been looking for answers ever since. After no solid responses form the location I had my taxes done at in Philadelphia, I received a different explanation every single time I got through. It was a nightmare even to get that. I had to call 4 times in two days to get a call back. At that time it turns out my rep had been given the wrong information and would get back to me after researching. 2 days and nothing. I called again 3 times, no answer, so frustrated I called customer service. I had to set a phone appointment with the rep to even receive a call back. In this cal back I was told all H&R block IRS payments would not be taken by the IRS until the 15th. Sounded odd to me but okay. This was told to me on April 3. I called again on the 15th right at 9am and my tax rep happened to answer the line. She told me very rudely that she had said "around the 15th" and if it was taken today I wouldn't see it until tomorrow anyway. Okay maybe so. So i waited until the 16th. The payment was still NOT made. At this point I called customer service again. They tried to put me in contact with the location. I said absolutely not I need a resolution. I have had cases sent 3 times and have called the regional director and have gotten NOWHERE. I have no idea what this woman did with my bank information, if it is compromised, where it is, or who can access it. She literally has all my identifying information and has not used it for the intended purpose. They could have an identity theft case on their hands and NO ONE SEEMS TO CARE. I am infuriated and will not stop until this is resolved. the WORST service I have ever encountered.

I moved from Indiana to South Carolina and filed my 2016 taxes at H&R Block; trusted tax preparers at this company for all my tax needs since I started filing my taxes. Recently the IRS sent me letters saying that I didn't file all paperwork and I owe$9000 for late fees, fraud, and interest. I understand that I owe the taxes but the H&R Block 3742 Ashley Phoshate Rd. North Charleston, S.C. 29418 should pay all charges that has accumulated since they misplaced some of the paperwork I took in. I take all paperwork in every year and I paid this passed year when I moved back to Indiana. Thank you for time and hope you can assist me with this issue.

#1--It's impossible to speak to a real human being about a glitch in the software. This, after having completed both my federal and state tax documents, but before I filed, I needed a figure from my rental property for a local tax. When I went to that section, I discovered almost all the data had disappeared and I had to fill it in again before filing. The same thing happened to me last year, only on my other business. Had I not checked on that section this year, I would have filed a totally erroneous return.

Further, on last year's tax software, my estimated quarterly payments were calculated and coupons printed. This year, that didn't happen.

I was running late on filing my taxes this year so I went to the closest HNR block. We had 3 W2s and a standard deduction and HNR charged me $673 for my taxes. Since they did not mention the fee beforehand and went ahead and e-filed the taxes I was forced to pay the fee. Beware of this place. I feel like I was put in a spot and forced to pay much more than I should have.

Location - 922 Market St Philadelphia PA 19107

Tax Consultant - Cindy Moss

The one in High Springs on 27 are very rude. I work next-door at a preschool. They have came over multiple times complain about our parents parking in their parking lot for only 3 to 5 minutes. We only have three parking spots on the road. I went over next-door and asked politely if they could move so our children were not in the road. The receptionist who is the one that been complaining wouldn’t even look up at me. She rudely told me no that our parents can park behind their building?. The customers were very rude also. The receptionist proceeded to tell me and all of the customers that it is a public parking spot. H&R Block is private. If it is private then why are we allowed to park behind them but their customers can’t!?

I had a local H&at Block file my Deceased Mother’s taxes several months ago. Susan, who did them told me there was a problem filing for the state of CA and she was going to mail the forms in. Well over a month later I called to see what the status was with CA Return and she said she “dropped the ball” and never mailed it! She said she would “mail it right away and call to let me know it was done.” I have still not received that call and today is April 15th! I have left 2 more messages for her, with no response. We are trying to wrap up my Mother’s Estate, and Susan is the only thing holding it up! Why am I PAYING someone else to complete a job that has NOT been completed? Now I fear penalties for being late. How am I supposed to know that she completed her job?

I used your h &r block on line filing and services. I had a question and was chatting with a “ tax pro” I received no results and proceeded to waste 2 hrs .She told me to submit a 1099R from a bank that did not send me one. Then got angry with my upon deleting info. I feel as though she wasted my time constantly being told As to click away the time. She seemingly had no idea of what I was trying to get help with .I ended the chat frustraded and completely dissatisfied Please review my chat I am officially requesting a refund of charge from this “tax pro “service.

The manager at the Window Rock, Arizona location has no clue how to run an office. I dropped of my W2 last week scheduled an appointment with my regular tax preparer. I arrive 20 minutes prior to my appointment time today, and told I have no appointment! I ask the manager I saw you last week, you scheduled the appointment what happened? No explanation, she pretty much blames it on her coworker, no apology, no responsibility what so ever. I have always come to location to have my taxes done and received excellent service. Said to say not this year!

2 thumbs down

Ur guy Aaron Zonana was a idiot. Not only did he not explain what he was doing with my return but did not help me in any way to help me understand why the figures came out the way they did

He was not helpful, did not explain fees

I had to actually email him forms for me to fill out

U cost me 3x the amount that turbo tax would have cost me for the same exact service

I WILL NEVER USE YOUR SERVICE AGAIN AND WILL TELL ANYBODY THAT ASKS THAT YOU ARE NOT WORTH USING

IN FACT I AM CONSULTING LEGAL ACTION TO STOP YOU FROM RIPPING OFF OTHER TAXPAPERS FROM USING YOUR SERVICE

Last year I had my tax at hr block they were done wrong IRS taxes were not done nor newyork state were done the lady o ly did new jersey.so I came back this year and they were amended..last year I got the insurance when it was time to pay me the insurance they short change me by 314.00 dollar tell me nj tax own me 300.00 and state the nj taxes were amended a second time I try to ms norma about my second amended I left a mess never received a call back yet

I went to the H&R block nearest to me to file my taxes. The tax preparer did not go over the pricing prior to doing my taxes. Once she was done she informed me my bill would be $253.00. I was expecting the price to be much lower since I had filed with HR block years prior and payed much less. As a full time student not currently employed It is not in my budget to pay $253.00. As she did not go over the pricing prior to doing my refund I had no idea what I was in for. I expressed my concern and the only solution the office offered my was to cancel my entire tax preparation and to have me pay $25.00 for the tax preparer's time. The whole process took an 1 hour and 15 minutes. I now not only had to pay $25 dollars for absolutely nothing but over an hour of my time was wasted and I now have to file on my own which will take me more time. It was also a very awkward situation to be in. I expect H&R to refund me the $25.00.

While your offices do not open on time (7 AM CST), after getting a representative, they are unable to help or provide proper technical support. My downloaded software won't open (It crashes at opening) and I can't convince anyone to get me to a technical IT specialist that can help me fix this issue.

I can be reached at 612.396.6428.

I did a drop-off tax return. When it was completed I got a call from the receptionist saying my return was done and we set up a time to come in at 6pm and sign the paperwork. When I arrived the paperwork wasn't ready and I was told to come back the next morning because the tax preparer was too busy with another client he had already. I left the office while my husband stayed to talk and figure out what was going on. So the tax preparer comes out of his receptacle and shows my husband a list of items that we are missing for our return. We had some of those items last year but not this year which I explained to the receptionist. There were things on the list that never even applied to us that could've transferred from last year's tax return. For instance, one thing he said we were missing was my income. I haven't worked since 2016. I have no income. Only my husband works and we turned the w-2 in. That couldn't have been on last year's return. Point is, I am not happy with the way things were handled when I showed up expecting to complete my return. I no longer live in that area but I still went to that one in particular because of the exceptional service the previous year. My tax preparer is Timmy Ogunsemi located at the H&R Block at 202 Hwy 54 Unit 405 Durham, NC 27713.

I just retired and moved in with my elderly mother. She mentioned that HR&BLOCK

did her taxes. Its just around the corner so I went there to have taxes done.I know taxes are pretty inexpensive these days. Long story short I was SHOCKED when she charged over $250 to have my taxes done. I was NEVER told until we were TOTALLY finished how much it would cost .IT WAS NEVER DISCUSSED. I could have taken them to a library or senior center and had them done for almost nothing. I am just sick about this especially when I read that pricing was suppose to be discussed AHEAD of time. I think I should get my money back. Rita Moon

My daughter normally does my taxes online but I have since moved to Michigan. My mother suggested I go to H&R Block because you did a good job and it was inexpensive. I probably could have gone to a library or to a senior center to have my taxes done for free or close but you are right around the corner from where I live so I thought I don't mind paying a little bit to have my taxes done. I was not at any time shown what this was going to cost me. Until she totally finished and told me it was over $250! And from what I understand what I read I'm supposed to be given an estimate before we even start. I was not given that! I would like my money back! She never verbally or physically told me what this would cost until we were TOTALLY finished.

H&R Block over charged services and I bring evidence that the charge has been paid and they send me a case number and an email apologize and clarify and that in 10 days I will receive the refund of the over charge and it has been a month and I didnt received anything. I call to the client service and nobody can help because they dont know anything and same in the office.

Made a payment arrangement for money owed to h& r block .which is just like a contract but instead of honoring this h&r block stole the money from my tax return .What kind of sneaky business is that.15 year customer us going to leave.

I have decided to use H & R Block to do my 2018 income taxes. I was not satisfied with their services at all. I'm very upset.

First of all, the person who had done my taxes was not professional. I had to help her with some printing issues she had on her computer. I was told to come back another time until the computer was fixed. In the meantime, the employee of H & R Block tried to reach out for help from her IT department without success. As I had to return a second time later that day, the printer was working. Since I was getting a refund from the Federal Government of Canada, I was not given a choice on how to receive my refund. A H & R Block Visa credit card was the only option I had to take in order to receive my refund. H & R Block didn't know how to submit my refund on this Visa credit card as I began to worry. I had to wait 3 weeks in order to use this H & R Block visa credit card ! I was charged $ 150.00 CAD + $ 19.95 CAD extra for this service including deposit and handling charges that they didn't accounted for !! I called head office 3 times and file a complaint. Since then, I"m still charge with these extra charges that was not aware of. I"m no longer going to file my taxes with them.

It was bad enough Lee Noel,at the H&R Block located at 13909 Nacogdoches Rd San Antonio, Texas was offensive during our tax preparation,she again displayed poor customer service when I called today to inquire about a problem. During the preparation,made a snide comment about being "just a housewife",and a condescending tone to her voice when making a comment about my former employment,a company I had worked for since 1998. Her nasty tone did not entice me to disclose any personal reasons,which were none of her business. Today, I called, because our check was $278.95 less than what she said it would be. After politely describing our check was less than it was supposed to be,she snidely asked,"annnd?"

The help she was willing to give was tell me,"the IRS accepted your return. If you have any outstanding debts,school loans,back IRS fines,they'd take it out. Call them,they accepted it." We have neither.

Over 20 years,I've used this company. After the preparation, was planning on using anyone but her in the future. Today I'm questioning whether or not I'll be using another company altogether. My work history is in customer service, hers requires intervention for customer satisfaction, and company income stability. It should not matter what kind of income a customer has to be treated with decency.

The Upfront pricing is Bullshit!!!!! They had the prices posted, but hald I known it would cost 450.00 to file my taxed I wouldn't have filed with H&R Block on Shelby Street in Indianapolis, Indiana.

I am trying to get an issue resolved regarding my income tax return. Our income taxes were filed online at H&R Block.com. in the process H&R Block offered a $100 bonus. the option we chose was the gift card from Amazon. On March 13th, $4.00 was deposited to our checking account, the other $2000.00 was wrongfully sent to Amazon. I have spoken with both H&R Block and Amazon multiple times to no avail. the following is a detailed statement of the process i have been through to attempt to resolve this matter.

To whom this matter concerns:

The following information is to the best of my knowledge.

My wife filed our income taxes(as she does every year) with H & R Block on February 6th, 2019. While preparing the taxes, it was offered to us that we would receive a $100

bonus as a first time filing customer. One of the choices was for us to receive a gift card from Amazon, this is what my wife chose. On March 14th, we received to e-mails from

Amazon, one for the $100 and the other $2000. At first we didnt do anything and waited for our refund to be deposited into our checking account. After about a week, we decided we should look into this matter and get some answers. I made a call to H&R Block, I got the run around and I was told it was in the hands of Amazon. So I called Amazon and on the first call I was told that H&R Block would have to cancel the transaction so that the $2000 could be sent back to H&R Block. In the next few days, making phone calls, we discovered that on 3/13/2019, $4.00 was deposited into our checking account. I called my bank to look for any information as to where the $2000 of income tax money went to. So making more phone calls to H&R Block, we finally find out that on 3/13/2019 H&R Block send the $2000 to (you) Amazon. On Wednesday 3/20/2019 I make a call to Amazon to get some answers, I connected with Miguel, explained the situation to him, he stated that would call H&R Block and have us on a 3way call, to explain that all H&R Block has to do is cancel the transaction. In the next 2 hours(plus), Miguel and I were bounced from department to department with each one stating that they could not do anymore and the next department would take care of us. Miguel finally became frustrated as well as I did with this, and hung up on H&R Block, and stated to me that he had an Idea to resolve this matter. Miguel said that we would have to go to the e-mail that we received and claim the $2000 on gift cards, this was by far what we wanted to do, but at this point felt it was the only option to retrieve our income tax money. So we started the process of buying $200 gift cards, 3 of them on 3/20/2019, 3 more on 3/22/2019, and then 3 more on 3/24/2019. On 3/24/2019 we received an e-mail that stated the payment was declined. This was confusing to us so I made another call to Amazon that night. the gentlemen we talked to figured out that our attempts to purchase the gift cards was done incorrectly and that none of the transaction were processed, and that our $2000 was still in that hands of Amazon. I made another call to Amazon on Monday 3/25/2019 and after talking to two agents I was transferred to Emily. Emily took a statement from me and said that she was sending this information to the card services department, that they were better equipped to handle this matter and that she would get an answer from that card services department and return a call to me. I never got that call and then made another call to Amazon on 4/1/2019, explained the situation to this female person(no name), she put me on hold, investigated, came back and said that a case file was generated. On 3/30/2019 we received an e-mail from Amazon stating that even though there is alot of this same information that it is requested of us to send an e-mail in explaining in as much detail as we could.

In closing, we have done our best to give you complete and accurate information to get a resolution. Thank you for taking the time to review this information.

According to Erica Royse (amazon), H&R Block just needs to contact the Amazon Corporate Gift Card services department, cancel the gift card transaction so I may receive my income tax return.

Sincerely, Joseph & Diane DesLauriers

I made an appointment with the H&R Block in Mainz Germany. I spent 20 min with them and took their advice on filing. They were “so busy” that they sent me away to work on my taxes. This consisted on filing a 1040X and then completing the paperwork. Three days later I received a bill for $354.00. When I went in to finalize my filing they did not even have the courtesy to help me electronically file or even show me what exactly they did. $354.00 for what? I would like to here back from management. This is unacceptable.

Your company pulled my SSN from the cloud or somewhere & put it on my son's taxes at your office branch. I used the new snap shot of your w-2, but did not file. Only checking to see what I would get. Not realizing this I filed electronically thru turbo tax and got denied because someone else used my SSN. This started a huge mix up and took several days too figure out. Your branch office helped us, but I had to file by mail and have at least another 12 weeks to wait on my return. I am in desperate need of my return and usually have it before the 2nd week of February! I am getting more agitated every day I think about it. Called the IRS and it took them an hour to find my papers or it would have been longer!! Your company needs too look into how this could have possibly happened and fix it. I am thinking of talking to my lawyer because there is something shady and would like to have my money and have you wait. How many times have my SSN been used since then. Please make sure this doesn't happen!

Regards

HELEN QUINTA SCHENCK

qschenck@comcast.net

7307 WESTMINSTER COURT

UNIVERSITY PARK, FL 34201

April 2, 2019

To: H & R Block Complaint Dept.

Subject: H & R Block Complaint

Gentlemen:

I have been an H&R Block customer for over 10 years and have never experienced a major problem until now. I use a desk top computer, Microsoft, Windows 10.

April 2, 2019 8:30 am I completed H & R Block 2018 FULL VERSION TAX SOFTWARE DELUXE FEDERAL AND STATE. The finished report was ready to print……..it did not print for mailing, This is what was printed on top of my printed tax forms

“DRAFT FORM - DO NOT FILE. Final form will be available through a program update.”

Following the directions on the screen I hit the update button over and over again…to no avail. I called the 1-800-HRBLOCK (800-472-5625), reached a lady agent. I answered her questions and she proceeded to direct me to hit keys for over an hour until she finally

said “she was transferring me to someone else who could help me. The diskette was faulty and H & R Block has problems with this program and I could not make updates on my computer because it has an outdated Federal Verification #3901 and THE CORRECT CURRENT ONE IS #8301.”

The agent continued hitting keys into her computer and requesting me to do the same to update the software. Her actions took up a lot of time to try the things an agent does, only to end up with me not having access to the internet. At this point her directions left me with a totally unfamiliar screen and no internet connection. I could not open anything. In the lower right hand corner of my screen was a picture of an airplane, I was in airplane mode. I had been deleted from the internet. She said “she was transferring me to someone else. She did not give me her name. It was now 11:00 am. I started working with her at 8:30 am.”

At 11:05 am the new agent was a gentleman who struggled to unravel this computer software and hard drive problem. Nothing worked…was with him over an hour He could not fix the problems and hung up after 12 noon, leaving me hanging with no internet connection. He did not give me his name.

12:30 pm I called Computer Doctors my technical assistants and explained I was in airplane mode, with no internet connection because H & R Block agents attempts to fix a software problem. They told me a technician would be at my home by 3:00 pm.

12:45 pm I tried once again to see if H&R Block could solve these problems. I called 1-800-HRBLOCK (800-472-5625) explained about the faulty 2018 tax software. When I reached the next agent she applied a case #1596363 only for her to say “I was in the wrong department” and transferred my call to someone else. I held on for twenty minutes, no one answered. I hung up and waited for Computer Doctors. This was an exhausting day.

3:05 pm Computer Doctors arrived. Technician: Brad Here is his diagnosis & Solution.

“Problem: Couldn’t print using H&R Block software…called for support, they (H&R Block) remotely connected and somehow after the network connection was lost and in permanent airplane login credentials to the pc were changed as well. PIN was removed and password changed …was able to rollback computer to previous day undoing changes made. “

“Solution: Was able to update feature. Had to change the screen resolution to allow the print button to be seen. Software does not scale to the screen resolution. Left computer as max resolution. Updated the Microsoft account password. “

He was here 1 hour and fifteen minutes cost rate $99.00 per hour. He put me back on the internet.

I am requesting reimbursement for the defective diskette and the cost for Computer Doctors house call. I am not responsible for the cost of 2018 tax software which is defective or the technical assistance required to clean up the technical problems created by H & R Block’s agents.

Attached are copies of the invoices

2018 Tax Software, Deluxe + State $48.10

Computer Doctors technical assistance house call $123.75

H&R Block

H. Quinta Schenck,

Thanks for purchasing H&R Block 2018 Deluxe Federal + State. You’re on your way to getting your maximum refund -- guaranteed.

Name: H. Quinta Schenck

Address: 7307 Westminster Court

University Park, FL 34201

Product: H&R Block 2018 Deluxe Federal + State

Product: H&R Block Tax Identity Care: No

Credit card: xxxxxxxxxxxx4021

Price: $44.95

Sales tax: $3.15

Total: $48.10

COMPUTER DOCTORS

1 / 1

Invoice No: 2127

Date: 04/02/2019

Bill To: Helen Schenck

qschenck@comcast.net

7307 Westminster Ct

Bradenton, FL 34201

Invoice

PO Box 1667

Palmetto, FL 34220

(941) 739-3600

Problem: Couldn’t print using. H&R Block software - called for support, they remotely connected and somehow after that network connection

was lost and in permanent airplane Login credentials to the pc were changed as well. PIN was removed and password changed

Solution: Was able to rollback computer to previous day undoing changes made. Was able to update software using the auto update feature.

Had to change the screen resolution to allow the print button to be seen. Software doesn’t scale to the screens resolution. Left

computer as max resolution. Updated the Microsoft account password

Description Quantity Rate Amount

Hourly Rate 1.25 $99.00 $123.75

Payment Details

Credit Card

Subtotal $123.75

Total $123.75

PAID $123.75

Balance Due $0.00

Your company pulled my SSN from the cloud or somewhere & put it on my son's taxes at your office branch. I used the new snap shot of your w-2, but did not file. Only checking to see what I would get. Not realizing this I filed electronically thru turbo tax and got denied because someone else used my SSN. This started a huge mix up and took several days too figure out. Your branch office helped us, but I had to file by mail and have at least another 12 weeks to wait on my return. I am in desperate need of my return and usually have it before the 2nd week of February! I am getting more agitated every day I think about it. Called the IRS and it took them an hour to find my papers or it would have been longer!! Your company needs too look into how this could have possibly happened and fix it. I am thinking of talking to my lawyer because there is something shady and would like to have my money and have you wait. How many times have my SSN been used since then. Please make sure this doesn't happen!

Regards

HELEN QUINTA SCHENCK

qschenck@comcast.net

7307 WESTMINSTER COURT

UNIVERSITY PARK, FL 34201

April 2, 2019

To: H & R Block Complaint Dept.

Subject: H & R Block Complaint

Gentlemen:

I have been an H&R Block customer for over 10 years and have never experienced a major problem until now. I use a desk top computer, Microsoft, Windows 10.

April 2, 2019 8:30 am I completed H & R Block 2018 FULL VERSION TAX SOFTWARE DELUXE FEDERAL AND STATE. The finished report was ready to print……..it did not print for mailing, This is what was printed on top of my printed tax forms

“DRAFT FORM - DO NOT FILE. Final form will be available through a program update.”

Following the directions on the screen I hit the update button over and over again…to no avail. I called the 1-800-HRBLOCK (800-472-5625), reached a lady agent. I answered her questions and she proceeded to direct me to hit keys for over an hour until she finally

said “she was transferring me to someone else who could help me. The diskette was faulty and H & R Block has problems with this program and I could not make updates on my computer because it has an outdated Federal Verification #3901 and THE CORRECT CURRENT ONE IS #8301.”

The agent continued hitting keys into her computer and requesting me to do the same to update the software. Her actions took up a lot of time to try the things an agent does, only to end up with me not having access to the internet. At this point her directions left me with a totally unfamiliar screen and no internet connection. I could not open anything. In the lower right hand corner of my screen was a picture of an airplane, I was in airplane mode. I had been deleted from the internet. She said “she was transferring me to someone else. She did not give me her name. It was now 11:00 am. I started working with her at 8:30 am.”

At 11:05 am the new agent was a gentleman who struggled to unravel this computer software and hard drive problem. Nothing worked…was with him over an hour He could not fix the problems and hung up after 12 noon, leaving me hanging with no internet connection. He did not give me his name.

12:30 pm I called Computer Doctors my technical assistants and explained I was in airplane mode, with no internet connection because H & R Block agents attempts to fix a software problem. They told me a technician would be at my home by 3:00 pm.

12:45 pm I tried once again to see if H&R Block could solve these problems. I called 1-800-HRBLOCK (800-472-5625) explained about the faulty 2018 tax software. When I reached the next agent she applied a case #1596363 only for her to say “I was in the wrong department” and transferred my call to someone else. I held on for twenty minutes, no one answered. I hung up and waited for Computer Doctors. This was an exhausting day.

3:05 pm Computer Doctors arrived. Technician: Brad Here is his diagnosis & Solution.

“Problem: Couldn’t print using H&R Block software…called for support, they (H&R Block) remotely connected and somehow after the network connection was lost and in permanent airplane login credentials to the pc were changed as well. PIN was removed and password changed …was able to rollback computer to previous day undoing changes made. “

“Solution: Was able to update feature. Had to change the screen resolution to allow the print button to be seen. Software does not scale to the screen resolution. Left computer as max resolution. Updated the Microsoft account password. “

He was here 1 hour and fifteen minutes cost rate $99.00 per hour. He put me back on the internet.

I am requesting reimbursement for the defective diskette and the cost for Computer Doctors house call. I am not responsible for the cost of 2018 tax software which is defective or the technical assistance required to clean up the technical problems created by H & R Block’s agents.

Attached are copies of the invoices

2018 Tax Software, Deluxe + State $48.10

Computer Doctors technical assistance house call $123.75

H&R Block

H. Quinta Schenck,

Thanks for purchasing H&R Block 2018 Deluxe Federal + State. You’re on your way to getting your maximum refund -- guaranteed.

Name: H. Quinta Schenck

Address: 7307 Westminster Court

University Park, FL 34201

Product: H&R Block 2018 Deluxe Federal + State

Product: H&R Block Tax Identity Care: No

Credit card: xxxxxxxxxxxx4021

Price: $44.95

Sales tax: $3.15

Total: $48.10

COMPUTER DOCTORS

1 / 1

Invoice No: 2127

Date: 04/02/2019

Bill To: Helen Schenck

qschenck@comcast.net

7307 Westminster Ct

Bradenton, FL 34201

Invoice

PO Box 1667

Palmetto, FL 34220

(941) 739-3600

Problem: Couldn’t print using. H&R Block software - called for support, they remotely connected and somehow after that network connection

was lost and in permanent airplane Login credentials to the pc were changed as well. PIN was removed and password changed

Solution: Was able to rollback computer to previous day undoing changes made. Was able to update software using the auto update feature.

Had to change the screen resolution to allow the print button to be seen. Software doesn’t scale to the screens resolution. Left

computer as max resolution. Updated the Microsoft account password

Description Quantity Rate Amount

Hourly Rate 1.25 $99.00 $123.75

Payment Details

Credit Card

Subtotal $123.75

Total $123.75

PAID $123.75

Balance Due $0.00

One of the most horrible customer service experiences I've ever had the I areas had told me that they had deposited my IRS tax federal refund in to the bank account on the Emerald card and it was on the April 2nd on April 4th 1 I called customer service Emerald card they told me I had to wait until the 16th and that they Would not verify any banking are card information with me they just told me there was nothing they could do. I will never ever ever use H &R block tax processing system again what

Tax preparers Sherri Wells AFSP ay H and R block totally screwed up my taxes. I specifically ask that the onjured spouse form was completed before sending off my federal . Come back to pick up paperwork she did not even complete it. Second after paying and sending my efile i look through my paperwork and she Gave all the credits to the non injured spouse. I called to the H and R block and filed a complaint with her manager

I have filed a complaint and have not had a response. Actually tried several times and can’t get a response. How can I get a response. Please

The representative that I tried to work with had limited facility in English but I wanted to give her another opportunity after the terrible service for tax year 2017. No improvement, actually worse because she again could not find " date of birth" on my military identification card. Still had issues reading typed letters from charitable organizations. Adequate data entry. This year, 2019, H&R Block has new forms that require both filers' signatures but this was not mentioned until the tax forms were completed. When I returned the next day with my spouse's signature on their form the representative was unavailable and no one would sign in her stead. Ultra inconvenient, so I sent a copy of all the H&R Block forms to the local office with cc to corporate headquarters via registered mail. Time to find another tax preparer.

On or around January 29, 2019 I had my taxes prepared by H & R Block in Ladysmith, WI and within two weeks I had received my State of Wisconsin refund. On February 19, 2019 I received a State of Wisconsin, "NOTICE OF AMOUNT DUE - Individual Income Tax", Amount Due $1.151.00. The H & R Block Protection was purchased and I am covered. (PROBLEM) Employees Chris or Patti (715-532-6982) kept my Return for their follow up and told me to check back in a week...they were very busy. I waited the week and called...Was told they had not gotten to it. *Chris or Patti or whoever answered the phone sounded perturbed. Told me not to call them as they would contact me. Received an e-mail the the amount due was re-figured at around $350.00 and the State of Wisconsin would send me an update. Today, March 30th and I haven't received anything and don't know what to do next. I inquired again by e-mail. I was told to call the State to find out. I e-mailed back...I need a phone number or file number as I wasn't sure what to do. **I thought the 'Protection Plan took care of these high anxiety details. My filing was husband/wife with Social Security and my State Retirement benefit. *Should have been easy ($59.00) range but I was charge $200.00 with the Protection Plan included. Two weeks to go and I have no idea what to do next and the Ladysmith, H & R Block doesn't seem willing to pursue customer satisfaction. All I want is to know how much I need to RETURN to the State of Wisconsin so I can conclude this years filing. I hope someone can help me, only TWO WEEKS to go. Ladysmith has been sitting on 'their' 'ERROR' for SIX WEEKS and I am in a state of high anxiety waiting for ANY answer or direction...including phone numbers. Wasn't my protection aimed at solving these potential problems? SO far, something may have been done but NOTHING accomplished. Ladysmith Office has my Returns. I don't know what to do next...PLEASE HELP

We have been coming to the same place for a few years and the same lady at the front desk makes us feel terrible with the way she speaks to us. Not only are we the only ones not addresses with customer service, when asked for our personal information does not explain why she needs it. It makes me feel very uncomfortable with this place having my information. I booked the appointment online After the initial sign in she complained that I was with my partner but as the information shows I am common law and was making the initial appointment but clearly stated my significant other would be with me. As soon as we sat down, an email was sent to me cancelling the appointment. So, already upset with this lady I asked why I just received an email...her supervisor was there and both instead of apologizing gave me unprofessional looks along with saying they are not responsible for online bookings and it’s not their problem but the appointment is still booked and I should call the number online. At this point I walked away as non of what they were saying made sense. As others came in the door thought they were picking up the customer service so at least others were not treated as we were.

I've been a client 30 yrs. or more. 2017 changed filing office due to move. All went well. Returned for 2018 filing appointment. Block associate searches my name. Long story short. Voice in adjacent cubicle holds negative conversation as my info is read aloud. Turns out faceless employee did my taxes previous year. As I make appointment she comments "dont give her to me. I'm busy enough". Sadly, she had clients at the time. A disservice to them as well as myself. Unprofessional to say the least. You still have my business but never again at that location. Harbor Shops Havre de Grace Md.

We were told we would receive a refund of $5,278.00 and paid $328.00 for a service fee. Left office, got home later and was told there was a "glitch" in the H&R Block calculation software. Since taxes already filed, we had to write a check to the IRS for $1374.00. Home office sent us a refund of $130.00, insulting!!! Went to office and agent had manager sit in, when I asked for a refund of the $328.00 minus the $130.00, we were told they didn't charge us the $100.00 amendment fee. This was not our fault! Never. Ever. Again.

Do not use H&R Block, 2625 Lawndale Dr, Greensboro, NC 27408. And the agent was Jeannie B Fisher.

Sent a email

Zero stars

I filed my taxes with h&r block I paid for a representative lawyer to represent me if the irs start harassing me about anything. It is the tax preparer that approved an advance for me and lied to me how much money I would be getting back on my tax return then said I was approved for the advance. I receive the advance and in a week or two later I came back to file my taxes it was a scam. I never was getting that money I was approved by the loan for because I did the advance before and by my pay stub I show them I get approved. How did I get approved in the first place, the representative lawyer I paid you for against the irs I need them to represent me on this scam saying I have to over pay my refund.

Had taxes done on 3/11/2019 at H&R block in potosi mo. Was never told cost of tax prep til I got home and was looking at papers and saw I was charged $340 for standard deduction head of household with 1 dependent, no itemizing at all. $416 dollars total with other fees. I called into office and he said he would give me back $90. I use to always have my taxes itemized in the past at another tax place and it was never over $200. I feel I was overcharged at least $200. What is the price for a standard deduction married filing separate, no itemization? Won’t ever use H&R block again.

Linda Mang took over a year ( 15 weeks prox.) to cancel my corporation at the Liberty Plaza, Erie,Pa. site. She asked me if I cared how long it took and I did not care. However I didn't realize it was going to cost me another $500.00 to complete the cancellation in 2019 after the 2018 cancellation.