Contact Wells Fargo Corporate

Toll free phone number: 866-878-5865Wells Fargo is one of the United States top banking and financial services corporation. It is publicly traded on the NYSE:WFC and employs over 250,000 nationwide. In 2014 revenues were reported as US 84 billion.

If you need help with general banking call Wells Fargo customer service at 1-800-869-3557. If you need is online or mobile banking call 1-800-956-4442. If you need fraud help call the general banking number. If your need is business fraud call 1-800-225-5935. To contact the CEO, John G. Stumpt you may address your correspondence to him at 420 Montgomery Street, San Francisco, CA 94104. The corporate office headquarters phone number is 415-396-7152.

Wells Fargo was founded in 1852 by Henry Wells and William Fargo in New York City. The slogan is ‘together we’ll go far’. You may find social media presence on Facebook, Twitter and helpful videos on YouTube. Overall the most common complaints filed against Wells Fargo include home mortgage problems, loan problems, rude bank employees, and poor customer service.

Experienced poor service? File a complaint here!

Wells Fargo Contact Information

Report complaints to corporate and get satisfactionWells Fargo headquarters address

- 420 Montgomery Street

- San Francisco

- CA 94104

- United States

Company website

1-800 phone number

866-878-5865Support email address

customer.service@wellsfargo.comBetter Business Bureau rating

A+

Customer service hours

24 hours a day

Browse reviews of other Banks

- Merrick Bank

(8 reviews)42.5 - PenFed

(8 reviews)37.5 - Armed Forces Bank

(5 reviews)44 - USAA

(25 reviews)28.8 - Navy Federal

(16 reviews)30 - BB&T

(25 reviews)25.6 - Citibank

(102 reviews)26.862745098039 - Regions Bank

(25 reviews)21.6 - MoneyGram

(75 reviews)26.4 - Bank of America

(143 reviews)28.811188811189 - Chase Bank

(239 reviews)33.305439330544 - US Bank

(81 reviews)21.481481481481

Top Wells Fargo Complaints

Browse more than 320 reviews submitted so far

Great

I visited this branch 2 days prior and was told to bring back my social. When I come back with my social now they tell me bring proof of address . Joel Borofsky the manager at. 866 third avenue was so rude to me and advised me to bank with another branch when all I said was it’s inconvenient to come back and forth and telling me what to bring when I was just here 2 days ago. He told me because there’s no Wells Fargo in queens and I live in queens I should bank at another branch . Isn’t his job to make sure he secures more clients opening bank accounts at WF not sending me to another bank . He was so nasty to me and didn’t show me good customer service. As a manger I didn’t expect to be treated so poorly and he was provoking an argument with me and all I wanted to do was open an account now I don’t feel comfortable coming back and opening a account

I visited this branch 2 days prior and was told to bring back my social. When I come back with my social now they tell me bring proof of address . Joel Borofsky the manager at. 866 third avenue was so rude to me and advised me to bank with another branch when all I said was it’s inconvenient to come back and forth and telling me what to bring when I was just here 2 days ago. He told me because there’s no Wells Fargo in queens and I live in queens I should bank at another branch . Isn’t his job to make sure he secures more clients opening bank accounts at WF not sending me to another bank . He was so nasty to me and didn’t show me good customer service. As a manger I didn’t expect to be treated so poorly and he was provoking an argument with me and all I wanted to do was open an account now I don’t feel comfortable coming back and opening a account . He lacks customer service skills and came off racist towards me as a black woman.

My wife and I both have our retirement accounts with Wells Fargo, recently my Mother passed away and I needed a Certified Medallion (like a Notary) so my brother and I could collect our Mothers IRA money. I went to the local Wells Fargo branch in our small town and they were less than helpful, they would not sign my brothers since he didn't have a account with them and they wouldn't sign mine because the amount was separated. The total amount for her IRA was under 7k.

We both went to State Employees Credit Union were neither of us have an account and the lady was more than accommodating. I even offered to pay her and she said that wasn't necessary. My wife and I will be moving our IRA accounts out of Wells Fargo ASAP. Their reputation is very low and they seem uninterested in improving it.

I visited this branch 2 days prior and was told to bring back my social. When I come back with my social now they tell me bring proof of address . Joel Borofsky the manager at. 866 third avenue was so rude to me and advised me to bank with another branch when all I said was it’s inconvenient to come back and forth and telling me what to bring when I was just here 2 days ago. He told me because there’s no Wells Fargo in queens and I live in queens I should bank at another branch . Isn’t his job to make sure he secures more clients opening bank accounts at WF not sending me to another bank . He was so nasty to me and didn’t show me good customer service. As a manger I didn’t expect to be treated so poorly and he was provoking an argument with me and all I wanted to do was open an account now I don’t feel comfortable coming back and opening a account . He lacks customer service skills and came off racist towards me as a black woman.

bought a new truck in 2010 with $17,000.00 down payment. I had for 39 months with 41 payments In the year 2013 wells Fargo repossessions and made around ten mistakes by looking at my bank statements and wells Fargo month and yearly statements they don't match up why did they do this and sold it. I need your help. Thank you. Catarino Phillip Arismendez

30704 RODRIGUEZ Av

Shafter Ca.93263

My wife Maria Formont misplaced her card. The person on the other end of phone asked my wife what her previous address was before marriage, how much her pay check is weekly, how much our Mortgage is, why is this needed to cancel a lost bank card. There has to be a better way to cancel a lost card. We are not asking for 10,000 dollar loan. On like I can cancel my card with a simple push of a button. This just seems ridiculous and insane.

I have substantial accounts at Wells Fargo. Today I tried to get info on my checking account by telephone and was routed through a gentleman in the Philippines, who seemed to have all of my personal data at his fingertips. What is this? Can't you find anyone in San Francisco or South Dakota to handle these calls. I resent your asking me to give my account number and SS # to a foreign person, where I have no rights or standing. Is it not possible to reach a person in the USA to deal with? I called 800-869-3557.

Thomas Berge

bergeco@gmail.com

I am filing a complaint against Wells Fargo because they have made my life a living hell. Amanda Joyner have put things on my credit report that was not so. She have lied about my mortgage loan and my home equity line of credit. At first she put 60 days late and now it is 120 days late. I never been that late on my payment not even 30 day. To have person suppose working for on the behave of a custom. I am very angry and upset the way I have been treated in this process. When you call the person that working on your case, you call and don't call you back. I had a local Wells Fargo gentleman working with me that was very kind to me. He call and she( Amanda )was very arrogant, he was trying to explain to her. He told me that she would not listen. This was coming for another Wells Fargo employee. I have my law now and you will hear from him soon. The humiliation Wells Fargo has calls me a lot sleepless nights. All ways remember there is a God that sit high a looks low and you reap what you sow. Amanda those who support you in your work to do things to other . I hope you all the best.

My branch Ventura Oakdale the air conditioning is not working. The tellers are very hot sweating behind the glass dividers. It is only 10:00am. As customers waiting on line we are also hot and uncomfortable. Please do something about this immediately!

The address is :19900 Ventura Blvd. Woodland Hills Ca Please get in touch with this branch and fix their cooling system !! Thank you

Hi My name is Mi Jung Ku, formal customer in Wells Fargo, more than 10 years.

1. I used wells Fargo in St helen, 795 S Columbia River Hwy, Ste A ·(503) 397-9572, but since 2018 July, I moved to this address, I use Wells Fargo which is 1900 SW 5th Ave Portland Oregon.

I have been using this bank over 10 years and still use it. I also started my business since 3 years ago and still use my business account in wells Fargo and morn then $40.000.00/month use through my wells fargo business account.,

Yesterday, I asked 2 of my account's 6 month statement prints. But I got phone call from wells Fargo bank today in the morning.

That was "they need to charge $5.00 of my each statement copy."

I was shocked that over 10 years relationship with Wells Fargo, I have never asked to pay for statement copy. Even for 2018 tax report, I needed bank statement for 12 months for every single accounts and I got it. I thought that is a kind of service that Bank can provide good service to customer.

But this time I was very disappointed that Wells Fargo which is 1900 SW 5th Ave Portland Oregon, Manager”Carlie” said She helped me to have 12 month’s each account statements early this year but this time she needed to charge. If I don’t wants to pay for statements copy then I need to move my e-statement state to paper statement or do print by my self at home.

I tried to print my bank statement this January but anyhow I couldn’t see more than 3 month back statements. Also I work 9 am to 9 pm, Monday through Saturday so it was hard to print by my self.

I know that to ask bank staffs to print 2 of my bank’s 6 month statements is not easy but to give good service to one of regular long term customer is good way to keep them to use Wells Fargo Bank.

I told “Carlie” who is manager of Wells Fargo which is 1900 SW 5th Ave Portland Oregon branch, that “I don’t need bank statement copy from your branch and I will look for a different branch or I will consider to use Wells Fargo Bank. “Carlie” said Okey.

So as I mentioned above, it is really uncomfortable to use Wells Fargo Bank.

I need some services when I need and it should be easy to get it and use bank.

I really consider to move my account to other bank now.

I don’t know when it can be because I still have many of business check in wells fargo bank.

But I will really consider to move from Wells Fargo Bank to different Bank.

Thank you for reading.

If you need to call me then call my cell phone or e-mail me.

Mi Jung Ku: 213-700-5249

Miho90@hotmail.com

asked branch what documents were necessary to close a corporate safe deposit box, was told to come in and they "would see." I persisted and the branch representative would not provide an answer to my questions; namely, what documents did I need to bring in besides the Keys and my ID. the rep spoke with a safe deposit section but would not pass along any information, instead, telling me to call a Wells Fargo 800 number myself. so I did, and was told need only keys and id. when I told rep this, the reply was that the Wells Fargo 800 people did not understand banking. still no answer to my original question. finally rep told me I was rude for asking and to not contact her again. this is not customer service.

I am extremely upset about a recent conversation with an employee from your fraud department LAUGHING at my misfortune and proceed to tell me he could laugh cause he’s “not in customer service. He’s in the fraud department” and also told ME I needed to keep the conversation professional when (A) I don’t work for Wells Fargo (B) he’s the one laughing at me and (c) I didn’t yell or use any profanity. I am shocked at how I was treated by this “young man”.

Did you receive my complaint about your branch manager at the downtown branch of Wells Fargo? Edson Harrington Jr. 706-327-1129, harringtonedson.12@gmail.com If I don't receive an answer soon, I will go higher.

This morning I went in to order checks. I spoke with the Columbus, Ga downtown branch manager Ms. Vegas. I had experienced problems in ordering checks. At the old branch you closed, the manager Ms. Kelly was always friendly and helpful no matter what my problem was. Ms Vegas didn't want to hear me. I had tried to go on line,it would not work. I called the number and the Wells Fargo employee wanted me to list all of the checks I wrote last month with the check number and amount. I did get something about new security requirements. Why didn't someone explain this to me? I brought other concerns I had. The bank is now closed on Sat. She told me to drive to Bradley Park Drive (Miles from where I live. The atm frequently runs out of money on the weekend. She glared at me and said she couldn't help. I mentioned the long lines at the end of the month. She said she has 4 tellers. She was very dismissive of everything I said and when I left she pointed out that I had spilled something on my pants. I am 74 years old and this is the worst customer service I have ever received and from the Bank manager. Edson Harrington 706-327-1129 harringtonedson.12@gmail.com

I filed a complaint on May 19. I initially received execellent customer service. I was assisted a case manager Carlos from the executive office. In two weeks I called 4 times after that to check on the status and every time Carlos allegedly attempted to call me, yet he never did. Here I am 18 days later and it took another complaint email and an astute memebers in the executive office to realize Carlos wasn’t doing his job and hadn’t even Looked at the account in 4-5 days. Hopefully now we will get some resolve but I’m still wating

I have been with wells fargo since it was south trust bank. I had been without work for 2 years and my credit had gotten bad, I have always maintained my accounts with wells fargo. we had un unexpected death in the family and I needed $12000 to help pay for the funeral. I tried to borrow the money from wells fargo and was turned down quickly. first of all I am finally employed. I have always kept enough money in my accounts so wells fargo could easily take $1000 a month for 15 months to pay back the loan but yet I was turned down flat. I would have never believed how inhumain wells fargo is. for Christ sakes I am talking about burying the dead that was what this loan was for. I have finally come to realize wells fargo is not for people and is only interested in the greed for the company and to hell with me and my family.

After filing a complaint over a invalid ACH charge the merchant was credited the amount in question. I was not contacted for any of my documentation nor was I told of their decision this caused my account to go overdraft costing me three transactions at $35 each. Now that I am filling a small claims court action in then as a co defendant the address on where to serve them at is nowhere to be found and whenever I call their legal department I get hung up on.

I had a terrible treatment from one of your tech guys, Ron Schioldoger, a technology manager at Wells Fargo in San Francisco, the moment he approached my coworker and I, he started to talk to my coworker, my corker has a heavy Israeli accent, the moment he heard it he started to get condescending and smirking, I approached him trying to ease the awkward situation but he got more agitated an belligerent, unfortunately he knows what business we run so he went online on a different social media platform bashing us for the fact he is being condescending. I have been a customer at Wells Fargo since 1999 with 4 different accounts, never had any bad experience before with any of your employees, your employee has a German name, I don't know the Israeli accent ticked off or what but I'm sure you guys do not tolerations these kinds of behaviors.

I have had some financial difficulties this year due to health reasons and I went into the bank and one of your Bankers told me they would take two of my charges off for overdraft fee and they lied and only took one and I'm on a fixed income I don't expect a handout but I've had some health Austin IRS issues this year and live on a small income I have always defended Wells Fargo with all the bad publicity I've had friends a lot wealthier than me that I convinced to go to Wells Fargo and my daughter I convinced her to go there to get a home loan of $250,000 and this is the Gratitude I get lied to I will be closing the account and I've been with Wells Fargo quite a few years

I entered the Wells Fargo On Pacific Coast Highway in Corona Del Mar This morning at 9:00 AM. After entering I asked A young man if I could use the restroom. His response was no we don't have restrooms for customers. I said I always used the restroom down the hall. He stated that has been changed. Yea right. Any way, My wife and I walk the dogs a couple times a month down to the bank and make deposits for my wife's brother who is Scott Brooks and a very good customer. The young man was very rude and arrogant. He should be enrolled in a customer service class.ASAP

Thank You

John Easterday

I recently had to open a business account as the Wells Fargo Branch that I use stopped taking my deposits on my account that had been open since 2006. Regardless I understand the reason for this. What is now causing an issue is the deposit holds that get placed on all of my deposits into this new account since these same check writers that had been being deposited in the other account with you guys they would be made available the following business day. Therefore my business had good positive cash flow as needed. Well now I am in some cases depending on how things fall out looking at 10 days roughly before I see a deposit cleared for use in my account. This has now placed my entire business into a negative cash flow operation and is costing me dearly in fees from creditors needing to be paid with the funds that are in deposit hold. This may all be legal banking standards/laws, but when a customer goes through the trouble of getting the bank that the check was written against certifies that the check cleared and I provide that letter to you at Wells Fargo only to be told sorry we still cannot lift the hold. What is going on here? You have access to funds from a my deposit days before it gets credited to me and could be using it to make investments for the bank during this time. What a way to have free money to place short term investments using money you don't even allow your customer to have which they entrusted with the keeping of the money deposited. anyway not sure why the customer gets left holding the bills for what banks are doing with deposits. I am shopping for a local bank that can provide me with more personal services and is willing to work with their local customers whom actually care about their small communities. I guess I should have known that a national bank chain in a small town was a mistake.

I am very disappointed in how you treat small business owners.

This bank is the definition of corporate America! Service sucks! 88 year old woman has had money stolen from her account and nobody reported it to the Adult Protective Services. Thought bank personnel were all mandated reporters!??? Bottom line is they should of listened to her when she told them back in January that someone was stealing from her account - it took until May for them to finally listen and do something about it!

Just sent my complaint did you get my receive?

After moving two accounts, I left my IRA account which I wanted to stay with WF. My financial planner Melanie Rudolph called and asked me to move this account also.

Four of us went in to simply take 2 people off of an account.. Took about 45 minutes and up to 8 signatures per person. Would have been simpler to close account and open a new one but we were not advised of that. Ridiculously difficult. Loan account can be opened with a phone call. Then, to add insult to injury my daughter needed to use the restroom (we had also waited an hour to be served added to the 45 minutes to accomplish our mission) and was told they had no public restroom. We did not come off the street to use the facilities--we were customers who had spent entirely too much ridiculous time to accomplish a seemingly simple transaction. I have been a customer for many years having paid off mortgages and carrying a pretty large checking account. I am thinking of severing all ties with your bank because of this service.

Wells Fargo charges overdraft fees by paying large debits before small ones so they can assess more in overdraft fees. I spoke to customer service and escalated twice with the acct exec offering only half as a courtesy for their BS charges. They purposely do this to maximize overdraft charges and then accuse you of being irresponsible.

My husband & I are trying to refinance our mortgage. Tim Morgan is our mortgage officer. He has been wonderful. Unfortunately our good experience stops there. To get a half percent preferred reduction on the rate, we have to have $1million assets in Wells. With over $100,000 already in our accounts, we authorized the transfer of 8 CD’s totally $900,000 from Northern Trust to our 2 newly opened brokerage accounts with Wells Fargo. On March 29, all forms were completed & faxed as instructed. By mid April, only 6 CD’s has been transferred. Upon inquiry to Northern Trust, we found out the last 2 CD transfers were never requested. We called Wells & was told to refax some forms deemed incomplete, which we did again, twice. We are tired of the runaround and repeated calls that got us nowhere. There is no advisor assigned to us. Every call required telling story from beginning. If Wells cannot handle transferring simple CD’s, how can I trust you with more money? This has been the worst experience I’ve ever had with any financial institution. Today is May 1st, still 1 item pending. April 22 was intended closing date. What is your advice?

The Wells Fargo on highland and del Rosa in San Bernardino has a wall blocking the street from viewing the ATM machines and there is alway street people sitting on the floor behind that wall right next to the ATM machines , I know because I deposit cash most days from my work , they are always asking everyone withdrawing money for cash , I’m scared I might get robbed one of these days , so I try and use a different location , but since this is near my house it’s more convenient! I hope you can do something about this please !

Wells Fargo legal dept received an order from the CT drs to hold my funds until such time the judge determined if my funds were exempt. The judge ordered a certain amount of money to be reversed back to me. Wells Fargo legal department claims they can only accept the order to release my funds via mail or fax. The court has now mailed the order twice. The court doesn’t fax orders. Wells Fargo continues to claim they have not received the mail, or they cannot locate it, and that they are not responsible. I was told by the court that it’s Wells Fargo’s obligation to obtain the order, and release my funds, which is publicly available on the judicial website. Wells Fargo refuses to do so. This is the second year in a row that Wells Fargo has kept money illegally.

I had an very bad crisis and had to put my wife in a nursing home ;this is about an excellent employee who came to my aid .. he is the manager of my branch ;where i i have been doing business with for the past 20 some years . I don t know his last name ,his first name is Anthony . The business at hand was all about moving a good part of moving my finances around & i was very much in need of help;long story short Anthony was a life saver to say the least . He was com cool & collected and helped me greatly to solve all of the problems i had at the time .;he was kind .thoughtful and so very professional,he seemed to know just what had be done & did in such a smooth timely manner.I thank Anthony (as well as the other employees ) at the Maple Glen Pa Wells Fargo Bank for all of the help they gave me at my time of serious need . I will always do my banking with Anthony George Johnson kjgj332verizon.net

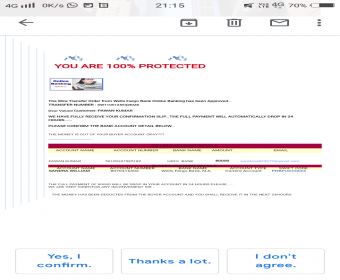

respected sir/madam My name is Pawan Kumar and I am from India. I sold my Samsung mob s10 plus to Miss Sandra Williams. She is the permanent customer of your bank and used your bank for this trade so I sent my Mob on 15 Apr through DHL Blue Dart Courrier service to Mr Sandra William Address and she recieved this mob on 19 Apr 2019 in this period your Wells Fargo bank sent me mail they get the amount of miss Sandra William and in very short time we sent it to your account but they didn't sent the amount and each time the bank sent the mail and create the problem for transfer the money so pl help me to resolve this issue I attach with the mail of the bank below .

I hope a favourable action from you

respected sir/madam My name is Pawan Kumar and I am from India. I sold my Samsung mob s10 plus to Miss Sandra Williams. She is the permanent customer of your bank and used your bank for this trade so I sent my Mob on 15 Apr through DHL Blue Dart Courrier service to Mr Sandra William Address she recieved this mob on 19 Apr 2019 in this period your bank sent me mail they debit the amount of miss Sandra William and in very short time we sent it to your account but they didn't sent the amount and each time the bank sent the mail and cream the problem for transfer the money so pl me to resolve this issue I attach with the mail of the bank below .

I hope a favourable action from you

After a 20 minute search on the Wells Fargo website to change my stocks to dividend re-investment, I finally gave up and called customer service. I spoke with a very professional and helpful lady, JENNIFER, that explained I would have to talk to a BROKER, even though I explained to the automated system I needed on line assistance. OK, only 25 minutes so far--Jennifer then said she would transfer me! So at 3:01pm I began to hold for the third level of assistance since your inadequate web site says nothing about dividend re-investment --other than a glossary definition. So, FINALLY AFTER 35-37 MINUTES ON HOLD !!!@#$#@!^%! I was helped by a pleasant and professional broker in your contact center in St. Louis, PEM, that explained there is no way on line to choose dividend re-investment, even when executing a new purchase. Of course every other brokerage house has that but not our customer oriented Wells Fargo. I am really FROSTED that I have to waste an HOUR of my time for such a simple task. This is the second major issue I have had with WF. The first was another hour wasted to find out the yield for my cash holdings. NO one could answer that after an hour so I transferred the majority of our cash out of Wells.--I think it was about 100K but don't remember now.

YOU REALLY NEED TO MAKE MAJOR OVERHAUL. I will post this on as many social media sites as possible because you do not seem to respond to governmental over-site. Do NOT DARE send me a form letter in reply to this complaint.

I was not able to deposit $500 in cash into my wife's WF account since my name is not on her account. This was a critical deposit since she is in Nevada with our children and in need of money. I was told ALL banks now have this policy which I was not aware of since I am not a customer.

I now have to obtain a check to deposit or go to Western Union, for a fee, to provide funds to my wife. Not sure why a check will be accepted and cash not. I could see if this was a large transaction but some common sense should prevail due to the circumstance of needing to get money to my wife.

The people at the Route 27, Edison were neither sympathetic, helpful or even concerned.

Very bad policy and bad attitude.

I will definitely stay with my PNC bank after this experience.

John Lenihan

Was informed i will not recieve a atm card 4 12 mos due to excessive refunds. To protect my acct. What they said it was internal investigation so didnt need to warn me i am on walker disabled 69 and now i hv go in bank get money or write checks so when explained my plight they said sorry all bills and food odered on line service dogs food etc. In emergency on a weekend no access to funds i am supposed to gt a reloadable card go gt funds each 3 then go and gt funds on card then go home to pay bills being disabled little hard to do and how do i know if emergency come up

I would like to file a complaint on the manager of the Wells Fargo branch located at Town Center (125 Independence Blvd.) Virginia Beach, VA. The incident occurred 4/13/19 where I tried to deposit two checks written out to me as the beneficiary of my mothers account. Both checks were from Langley Federal Credit Union. The manager accepted the large check but would not accept the 2nd check. Additionally, her attitude towards both myself and the banker was extremely condescending. Please have the appropriate person reach out to me to further discuss.

My ex-husband and I own a home together. We recently had damage done to our home and file an insurance claim. The insurance company sent us check made out to both of us with the word and between our names. I do not have a joint account with him at Wells Fargo nor do I have an individual account with Wells Fargo but Wells Fargo allowed him to deposit the check with both of us as the payee. with only his signature endorsement. Now I do not have access to the money to fix my home and he refuses to give it to me.

After 30 + years of banking with Wells Fargo my wife and I have decided to close ALL of accounts. Something as simple as opening a additional checking account has taken SIX weeks! We have been given excuse after excuse. “It’s not our fault”... from the branch manager. “It is in the cue at the back office”... bla, bla, bla...

I have been a customer of your bank for over 50 years dating back to the Nortwestern National Bank days. In that time I never posed a problem or experienced any trouble with my banking needs until now. I have been trying to open a home equity line of credit and shockingly have been declined. If this is how you treat your loyal customers I find it difficult to continue to keep my accounts at your establishment. With decisions like this how do you expect customers to remain a part of your bank? Please check my credentials and tell me I’m wrong.

Unhappy Customer,

Thomas Leitner

763-482-1927

I now have to go into the bank to order checks. It is very inconvenient, It appears as a way to allow the bank official the opportunity to high pressure you into purchasing additional products. I find it nothing short of harassment.

Why do I continue to use a bank that pays the lowest interest, constantly high pressures its customers, and forces the inconvenience upon customers to "come inside" just to order checks? My time is money also, I believe it is time to

move my account to a "friendly credit union"

Don't you think that is a good idea?

Edward Avery 4/11/2019

I fell about a month ago going into Wells Fargo the empees were nice all but one I called they wee ride my dr bills are up the roof it’s sad such a big bank no one care

I called on 18002898004 this phone number from Well Fargo bank .on the line there was voice of female. She wasn't helping me .Because I complained about my check was sent 02/27/19 to instead for due to first payment 8/3/19 .But they recieved my check already they still withdrawn the same amount of payment by the time 8/3/19 more time.by the time April/8 /19 they sent me a bill payment noted that your next bill due to is may /8/ 19 .they didn't note April so I believe in all payments ok.but today is 04 /08/19 I checked my app bank on my phone .they withdrawn money for payment. I said all like above meaning of words .she told me her words quickly .I said I need vietnamese to translate for me .she took waiting music was quite long time then stopped my calling .no any help no word to explain for me why likd that.i had to run to well Fargo bank on bolsa street Avenue in Westminster. There was a nice female she is vietnamese too .she helped me at all .even though she told to another line to help me also difficulty. I think that America country time not like people always say that time of living in America is very short time .all by those who like that make customers not fluent English or resist. No help no words . Working in bank office is very cool but they aren't still nice to customers. I HOPE the bank director should adjust and train them for servicing to customers goodly in the future.

I received notification out of the blue that Wells Fargo was closing my credit card account which I have had for many years. I was never late on my payments, always paid more than the minimum balance and have an excellent credit score. They could not give me an acceptable answer as to why my account was closed, and once my accounts are paid off with WF, I intend to take my business elsewhere.

I have banking with wells fargo for over 10 years and its constantly been some type of issue, but in the last few years it has been the worst. On Feb 22 2019 i went to the bank to withdraw my pay check at an drive thru teller and was informed that my account has been frozen and was told to contact customer service,Once i did i was notified so they can that i was considered an "Security risk " and they was closing my account and for me to go to an branch banker and they will take the freeze of my account so i can empty my account so that it can close and i did just that . i opened another account that same day (2-22-19) notified my bill collectors and my employers of the change. On March 7,2019 when i gotten paid again i notice my pay check from my other employer was not in my new account. i check the wells fargo account and the direct deposit was in that account called customer service because to my knowledge that account was closed and i had no access to that account , i was told that the funds will be returned to a teller because the account was locked. I notified my employer they issued me a paper check . Weeks later my employer called me and notified me that they haven't gotten there money. i looked at the account and it was several charges on the account that i didn't do .After several phone calls and no answers i make a claim on 3-25-19 after Iweeks of waiting I called to check on the claim was denied because it was no proof of fraud mind you i have no debt card and i thought the account was closed/locked as told to me by several wells fargo employers . and was told by a resolution specialist that they cant help and instead they hung up on me

Wellsfargo savings platinum pays 2 percent existing accounts pay .05 percent. Cutomer service said sorry the 2 percent is for new customers.So I said you penalize loyal customers and reward new. And he said that is the policy. I said that makes no sense. I said that I should close my account and move my money to another bank and there are a lot who pays better interest and he said that could be an option

Very Dissapointed

I have sent 5 emails regarding 415.50 taken out of my account 0608480158 preauthorized and asked that is not be taken out twice

It has been taken out a second time. This is very poor customer service

claim kmm71754860v82301l0km

Kenny Blue 2102388852

Back charging for years when trying to pay off 2nd mortgage...loan sharking is against the law. complaint phone with the Federal trade commission and also the federal consumer agency in Washington DC

To whom this may concern...On my way to work this morning i stopped at the nearest ATM at the Quick Trip on Sugarloaf by 316 which happened to be a WELLS FARGO...I put my card in the machine, went thru the whole transaction, & the ATM machine said "THANK YOU, PLEASE REMOVE CARD" only it didnt return my card & i received NO cash!! The employees said it was not their problem i had to contact WELLS FARGO which i did & all I get was " IM SORRY"...this caused me to be LATE for work, I wasnt able to put gas in my car & i have NO card to buy my lunch today!!! If the ATM was OUT OF SERVICE there should have been a sign on the machine or the ATM should have had a message on the screen saying "OUT OF SERVICE" like its suppose to when its not working. Im very upset because not only am i inconvenienced by this, now i have to leave work early today so that i can go to my bank & take care of this issue. I would appreciate being compensated for my troubles.Thank you

I went up to the Brookshire location branch on the suppose to be disability side it was such a leap no disability ramp I fell on my left shoulder mind you I just had a shoulder replacement on the 15 of February I call a branch in the headquarters dept and explain to him what went on mind you I only wanted them to Fox the problem and the rep said what do you want us to do about it rudely really I aggravated my shoulder

I was trying to refinance a family home. I talked to Gary parker Hearn at 1101 North Main St Anderson SC. He gave me the run around. All the information he asked for was given to him, then he asked for more information. I told him I did online banking. I pulled up information to show that information. Then he came up with something else. He had no intention on working with me in any way. And he never asked for my social security number. I feel like I was being discriminated against.

Well fargo doesnt care about there genuwine faithful and loyal customers.instead they train there supervisor to say no to everything.oh wait thats if they even awnser the phone.9 time out of ten the supervisor used to awnser calls as a representative before and once he or she gets promated they are to good to awnser phones and will do everything on gods green earth to keep from awnsering the phone.so they just pass on whatever mumbo jumbo they feel like they want the representative to tell you and thats it.the lazy supervisor and the employee who doesnt like being in the phone is wells fargos only line of accountability.while the people in the board room could give a dam about making there customers being happy.there to busy playing golf,and partying on yhats and chasing after young women on there buisness trips slash weekend escapades.probley feeling theres noses with the best south america has to offer while the common hard working man suffers at there leizure .happened in the bible the story of the rich man and the poor man,and is happining in 2019.nothings changed.they probley were little small white cakki shorts that end at the beggining of there thighs,with a sweater wrapped around there neck usually yellow or pink,or green over ther polo shirts.with there comb overs brushed to one side of there head trying to save the last remnants of the hair thats going on there head.there probley not happy either becouse they have everything they want and there stuck with martha who spends all the money and hasnt worked since they got married and wish they could have a younger women but they cant make a move until the kids go to college .so you know if there not happy they deffinety dont give a fuck about you and me.they probley have scotch on the rocks or jack every night and have a closet full of demons they try to hide from the world but eventually it comes out and another wall street guy goes to jail or does this or does that.it never fails.so to some it up wells fargo does not care about your complaints.and what ever you do never call the customer service and ask for a supervisor .if they supervisor not sneeking there phone l9oking at instagram or snap chat there probley finding other way to not be effective.

Hello my name is calvin mcclendon my last four of my social is 1727 ,i have held a account with wells fargo for the last three years.i have experienced the worst customer service ever , i personally would like to grow with wells fargo and build a working relationship with wells fargo i have been in the process of rebuilding my credit.i have obtained 2 credit cards and i wanted to go thru wells fargo in the future for a home loan .and also to put my savings from another bank into wells fargo.but i have been running into one problem after another.the one thing that just threw me over the top was very simple .i got my payroll check on 3/15/2018 me and my wife.the same day i received my payroll check i made a payment twords my credit card,for 50.00.to first progress secured credit card company,that was the first thing i payed while the fund were available,i know i takes 3 days to clear.so i am expecting a time frame of 3/18/2019 .i also had pymt madeover the weekend ,that cleared on 3/18/2019.What is making me upset is why would you cover the more expensive payments that were made after the payment i made on 3/15/2018 for 50.00 there were two or the payments that cleared on the same day 3/18/2019 for a higher amount.my priority was the first payment i payed on the 15th for 50.00 , i just dont understand why you would clear payment made after the first pymt for a lower amount and cover the higher amont made at a different day .I AM ASKING THAT YOU PLEASE MAKE THIS EXCEPTION AND REMIT PAYMENT TO A LOYAL CUSTOMER ,WHO WANTS TO REMAIN A CUSTOMER OF WELLS FARGO REMIT THIS PAYMENT TO FIRST PROGRESS SECURED CARD.Ive been on the phone with wells fargo for 1hour and 35 minutes .If i wasnt trying to improve my credit and become a customer wells fargo would value to have i would take the time out of my day to go threw the waiting and headache and hastle.but im trying to do the right thing and build my credit becouse i would love to go thru wells fargo for a home loan.man this is impacting my credit i have worked so hard to build.i wish sombody that reads this has some kind of compassion .Think back to a time before you worked at wells fargo wen you didnt have a good job, or was in college or if you fell into a hard time .and sombody was there to help you out.i was told that they could refund 35 dollars to my account , but that does not help me at all , becouse my account is negative .and will not do anything , im asking to remit pymt to the credit card company i made a pymt thru on the 15th wen i had the funds, or send me a check for 35.00 that i could use to pay my credit card.i have been on the phone now 1 hour and 59 minutes .this is crazy man , i really hope wells fargo can truley help me out .man the supervisor cathleen in the charlett phone bank refused to get on the phone to , that is another complaint.i guess she started off taking phone calls back to back , and once she got promoted she fills she is to good , to get back on the phones anymore.also the first representative that was on the phone allison , was not helpfull at all ,its like all she was trainned to do is say no .she is also based out of the charllet phone bank , she did not really want to help me out , and was really wanting to rush me off the phone rather then to understand and try to get to the bottom of my issues.ive been on the executive phone line on hold with robert i belive he said his name was for another 40 minutes now.this is rediculis!!!!!!!!!!!!!!!!!

would not even give you a star liars scammer's thieves

On 03/01/2019 I paid my daughter's rent online but on 03/07/2019 she received a notice from her complex stating the bank account had not been able to be located and there was not only a $100 nsf fee but late fees had been initiated. I went to my local branch at 13050 Coit Rd and purchased a cashiers check so she could pay the rent. Her name was misspelled on the cashiers check so it made cashing it next to impossible. On 03/11/2019 she finally found a place EZ Shop Check Cashing 818 S Central Expwy #21 Richardson, Tx. (972)238-0528 that would cash it but charged $50 to do so. I went to my bank and spoke to them about what happened hoping to recoup some of the money spent and my daughter and I were told that the branch manager didn't feel "comfortable" refunding any monies. We both reiterated that due to the name misspelling this had caused an uncomfortable situation having to spend money traveling multiple locations via Lyft as she didn't have a car and were told to contact customer service through your 1800 number. In fact during my visit there was more concern about the Lyft charges even to the point of having me change my pin than there was to resolving the issue concerning the fees I incurred as well as all the inconviences we experienced. I'm on a fixed budget and definitely do not have an extra $300 to spend on anything especially when it is due to bank error. I am currently considering changing banks.

I spoke to a wells fargo customer service agent two days ago, approximately 3/1/19 regarding why my atm card wasn't working. He then tried to explain to me that I had reported the card lost or stolen by me and that the card had been compromised. I explained to him that I had not reported the card as lost or stolen and that the company should not have deactivated the card without notifying me first. I explained that I did receive a new card in the mail, but that I hadn't activated the card and that the company shouldn't have deactivated my card without notification. He then tried to explain to me again that the only way the company would have deactivated my card was if I had reported it lost or stolen. I explained to him that I hadn't reported the card, I had just tried to use the card at the atm and that he was mistaken. He then repeated to me a third time that I had, in fact, reported the card lost or stolen because that's the only ways it would have been deactivated. I repeated to him that I hadn't reported the card lost or stolen and that I would like him to explain to me why the bank had deactivated my card. He then began again to tell me that I was mistaken and I repeated that I hadn't called the card in and he was mistaken, he then tried to talk over to me tell me that I was wrong and I then asked to speak to someone else because I wasn't going to be talked to that way while repeatedly being called a liar. I asked to speak with a supervisor because I no longer wanted to argue with him. He then snapped back at me that he was glad because he wanted me off his line anyway, then put me on hold for the next 15 minutes with no response from anyone. This was very unprofessional, it's why the company has been getting poorer and poorer ratings because it appears as if it doesn't discipline it's employees and teach them the proper way to handle their unsatisfied customers. I would have to give this employee a zero score and Wells Fargo a minus -1 for unprofessionalism. I would like a response to make sure that this complaint isn't just erased or sent to no one.

My name is Beatrixe Eugene (D.O.B 6/6/69) and I am filing a complaint on behalf of my Aunt, Beatrice Eugene (D.O.B 12/6/35), whom I was named after. My Aunt, Beatrice Eugene's, Account number is 1010130563147. She not only is legally blind, but she is 83 years old and had a stroke November of last year. She spent almost a month in the hospital. In February, she was taken to the bank by a family friend, and this is when it was discovered that someone hacked into her account and ordered over $1000 worth of things online. First of all, the bank should have flagged the Account once they noticed several online purchases, which is not like her since she is elderly and once again, blind. Secondly, a letter was received by David J. Wyatt stating that the funds will not be returned. This is highly unacceptable. We are prepared to file a grievance against wells Fargo because this is elderly Abuse and Fraud. Every dime should be returned. Here are the dates and amounts in question: 11/30 - $24.99, 12/10- $100, 12/14- $24.99, 12/14- $79.99, 12/14- $50, 12/19 - $79.99, 12/26 - $44.99, 12/28- $9.99, 1/2- $16.99, 1/2 - $79.99, 1/2- $79.99, 1/2- $44.99, 1/4- $2.99, 1/4- $0.99, 1/7 - $20, 1/7- $100, 1/8- $4.99, 1/9- $19.99.

Specialized Loan Services is a Joke. Have had nothing but trouble with them. Worst move Wells Fargo has made.

Had fraud scanners deposited 2 bad checks .I called the bank they told me the checks were good then 3 days later they told me that they were not good. They cost me a 1000 dollars I am not able to work because of dialysis. Would not recommend Wells Fargo

Wells Fargo failed to complete and send a retirement rollover form that was requested and received by Wells Fargo on January 7, 2019. This was discovered today February 20, 2019 after long and repeated calls. Past calls during the elapsed time period resulted in Wells Fargo saying the completed form was mailed to the retirement office on January 11, 2019. When asked about why the form was not completed and sent the response was we don't know. This is a no accountability answer. One that cannot be tolerated in the banking system. I cannot speak of the past performances of Wells Fargo, maybe at some point they were good at this, but not anymore.

Because of the data issues that Wells Fargo had, I was not able to recover my sign on for my mother’s account (that I am a signer on). So, we set up a new one under her information. My mother is almost 94 years old, cannot hardly walk and cannot hear or see very well. The on-line fraud department called and told me that they needed to verify her, she had to talk to her. Well after trying to explain she would not hear her, I handed the phone to my mother, who surprisingly COULD NOT HEAR HER, and kept telling her that she could not hear her. I could understand if this was a new account, but I am a signer on her account and I am the only that takes care of all her bills, and I am the one that is her care taker and I have been on her account for several years.

Now I must take my 93 years old mother that cannot hear or see very well, who uses a walker to walk what little bit she can to a flipping branch office to verify who she is and to make sure that she understands that I am the 3rd party and could be ripping her off......really. I am so disappointed in Wells Fargo, none of this would have happened if Wells Fargo did not have a data issue and my sign on could have been recovered. So why are we the ones that are being treated like criminals. This has really upset my mother this evening and myself, to the point that I am going to look at changing banks, if I must drag her out to a bank to verify who she is, then I should be doing it for a justifiable reason, like setting up a new account elsewhere.

Logged into my account to make an appt at my local branch to discuss options for our lending needs - line of credit, mortgage etc. Got a call from Monica to confirm the appt for 3:30 Feb 5 with "Michelle". My wife & I arrived at the bank 5 minutes early and waited & waited & waited. No one asked our name, purpose for visit , acknowledged our existence or if we had an appt...we left 20 minutes after the appt time had passed. We made the effort to prepare documentation and were interested in a $750,000 line of credit. We satisfied our lending requirements elsewhere. Very disappointing experience with our local branch!

My name is Chau Nguyen-Davis. I have been a Wells Fargo customer for many years since 2009. I just recently opened up an Intuitive IRA account at Wells Fargo. I went to the Wells Fargo branch across from Bella Terra in Huntington Beach. Sarah Pham was helping me at first and then I was successfully at opening the IRA and I specifically told Sarah and the customer service man on the telephone that day that I would like to put half of the money from the check and half into the IRA. Sarah and the man on the telephone both told me yes I can do that without explaining that it can't be done without the 10 percent fine or something like that. On Friday, February 15, 2019, I went back into the back to give the banker my check. This morning 2-19-19, I called the Intuitive IRA customer line and ask if the money is in and that can I go online to transfer the some of the fund into my checking. He said I can not do that. SO all this times, I was told wrong by your staff at the branch. Anyways, please call me back and discuss this issue further. Thank you!

i open a secured credit card with my wife 4 yrs ago my wife got hers unsecured mind they are still reviewing it for 4 yrs my income is 3,464.00 per month my wife makes 5,000.00 per month we pay 2,786.00 on our house our credit was mess up 10 yrs ago with housing market colapse. we nhave been a customer of wellsfargo for a long time. we have never been late on our credit card since we open it. if wellsfargo could not confirm my credit worthness its ok but iam trap i am using my own money for high interest but i could not closed the account it will affect my credit i am stock with this credit card how can you help me. thank you my account no 2456880034

My name is Phillip McNeill, I have been a customer for as long as you have had a branch at 7706 Richmond Highway Alexandria Virginia. On 2/5/2019, I went into this branch to cash a check for $2000.00. Everything when fine, I showed the teller my driver license. Mind you, this check was written to myself on my personal checking account. On 2/6/2019, I went to the bank with another check, same amount. It took me over twenty minutes to get it cash. The teller

ask for more identification, I said, I only had my license but I knew the managers. The teller said, you will need to answer three questions. I said, what if I can’t answer the three questions. Does this mean I can’t cash my check. The branch manager came over. I ask her, “Do you know me” she said, yes. I ask, why can’t you let this teller know so

I can cash this check. She had me there for another ten minutes, telling me all the rules and why three questions.

I tried explaining to her that I had cash a check the day before without any problem. But what did she do? She called out

the teller who cash my check the day before. I felt embarrassed for her. This was very unprofessional. I let her know that I would be filling a complaint, and I had another check to cash on 2/7/2019. I will have two identifications

I went to the Wells Fargo branch on Clinton and brawley in Fresno Ca I got the rudest employee ever I been a member over 15 years I always do the same transaction every month she was lazy and rude I had never been so disrespected as I was today

I HAVE BEEN A GOOD AND LOYAL CUSTOMER FOR WELLS FARGO. I cannot say the same for the bank's assistance to me. I have been trying for weeks now to get my on-line account working properly. It is impossible. I use every number I can find and still get nowhere.

Usually it wears down to what is my pin number< I don't have one, I have never had one. All I want is to check my account balances, etc,

to keep ahead of expenditures. Why is that so difficult? I email, call, go on-line, visit the local WF branch and it's like trying to communicate with

Vladimir Putin. Today is Sunday. Tomorrow my WF accounts are going to Bank of America.

May all of your business dealings go to Hell! Robert W. Benson, acct nr ending 0225.

I deposited a check on January 24th for 2500 from my husbands usaa account to pay bills. when I deposited it they said the funds would be available on the 25th of January. When I called on the 25th the funds were not in my account and the person I spoke to said that it was because the funds were not in the usaa account. My husband showed me the account and the funds were removed so I called wells fargo back again and this time they told me because of repeated overdrafts on my account in the past 6 months they are holding the money until FEB 4th. I have bills that need to be paid and they come out of my account automatically every month which is why I deposited the check to begin with. they told me there was nothing they could do over the phone and I would have to go in person to the branch where I deposited the check. So I just went to the branch and told them and they are now saying because I deposited the check in the atm there is nothing they can do. I've been told multiple different things in the past few days and all i'm trying to do is avoid more overdraft fees and pay my bills that NEED to be paid and no one can help me. I've been a customer since 2005 and now all I want to do is close my account. bills come out of my account automatically every month. This is nothing new. I've paid all the overdraft fees and never complained but all this is doing is putting me in the hole again. Not to mention the female that is spoke with at the branch was extremely rude to me. How do I rectify this so I can close my account. Can my husband stop payment on the check? can they makes the funds available any way so that my bills can be paid that are coming out this week? They are penalizing me for the previous overdraft fees but all they are doing is causing me to have more. Is that how wells fargo makes there money?? Any assistance would be appreciated.

If I could put zero stars I would have. Staff seem to be trained to make money for the bank instead of doing what is best for the customer. Customer service ranks about 3rd or 4th in their daily priorities. Customers are treated like they are an inconvenience. I went to branch to resolve my questions. I complained to another branch manager that Jo Lovato (Assistant Vice President) was ignoring numerous voicemails for 2 days about a time sensitive issue. He called me just before 5:00, I am sure prompted by other manger I had complained to. I told him I was unhappy with his treatment and that another banker had helped me. His response to me was "well you can just be unhappy" said goodbye and hung up on me. I am extremely disappointed with the Wells Fargo attitude of we come first and there is nothing you can do about it ! How do businesses like this stay in business?

Wells Fargo account activity notification! An automated payment to another bank for over $56,000.00 hit my account and rather than notifying me, Wells Fargo seized all accounts pending authorization and still never notified me. When called about issue was told it would be 5-10 days before problem was resolved and my accounts were freed up, money returned to accounts. This is the third major issue with WF in 5 years and I am about to close my accounts! The branch was more help than the so called 800 help line. So now we are just supped to live off credit cards or cash and not worry about any other auto payments that are coming into the account. Absolutely unacceptable and no assistance or accountability!

Last January 10, 2018, my brother and I went to Wells Fargo Bank at 2946 Chain Bridge RD, Oakton, Va to open a $10,000 CD and Savings account. We met with Rodrigo Cuellar. He listened to what our request was and proceeded to assist with opening both accounts. The complaint I have is that he should have been more helpful by suggesting a better option because the CD was for one year at .25 interest rate and the saving account of $3,500 was .05 interest. He didn't give any other options knowing that this wasn't a good one. I also called him on 12/27/18 telling him that I wanted to stop the CD. We went to the bank on Saturday 5th to find that the bank branch was closed on Saturdays.

We decided to go to the bank branch at Fairfax market and closed the savings account. Rodrigo Cuellar didn't tell me that I couldn't stop the CD until after the 10th. This Saturday 12, 2019, I plan to close all of my accounts and move to another bank that offers a better return on CD's.

As a resident of Bay County Florida, I experienced personal and business hardships during the recent storm, Hurricane Michael. My 9mo pregnant wife and I were forced to evacuate our home and she was a high-risk pregnancy. After a few days in Mobile AL with friends, I returned to devastation in Bay County and in my neighborhood of Bay Point in Panama City Beach FL. My personal home had damage and we were without power, internet, cell phone, and water for over one week. During this time, I learned about Wells Fargo offering extended time to pay loans through a friend who has Well Fargo account. I have had nothing but trouble since I try to pay my double payment this week on my car loan. I learned as a result of the 30 day late payment, I was turned over to the credit bureau and my credit score dropped approximately 100 points. I am a hard working businessman who has had several loans both business and personal with Wells Fargo in the past and present. My parents are loyal Wells Fargo customers and do all their banking at your institution. My grandmother has all of her banking needs through Wells Fargo, as well. Needless to say I am very disappointed as are my relatives and we are considering going elsewhere for our banking. All I am asking is to restore my previous score and make this right so that I may continue to recover post Hurricane Michael. Please reach out to me at 850-519-1871 or 850-774-6448 so we may discuss this situation and how to fairly resolve this. Thank you very much.

Benjamin W Alexander

CONSTANT HARASSMENT AT YOUR BAYVILLE, N.J. (08721) LOCATION, I CANNOT SIMPLY USE THE DRIVE IN WINDOW WITHOUT BEING PUT TO THE THIRD DEGREE FOR IDENTIFICATION. THE PROPER PRINTED FORMS MADE OUT IN ORDER, AND DRIVER LICENCE ARE NOT ENOUGH, TODAY I WAS TOLD TO COME INTO THE OFFICE TO FILL OUT PAPERS!!! WHY? MY MANY ACCOUNTS -TWO PORTFOLIOS ARE OVER 40 YEARS OLD AT THIS BANK, MY NEIGHBORS ARE COMPLAINING OF YOUR POOR MANNERS ALSO PLUS NO INTEREST ON OUR MONEY IS MAKING YOUR BANK A GREAT BIG PAIN IN THE ASS! THIS MORNING AFTER THE RUDENESS I ASKED FOR MY DEPOSIT BACK THEN DROVE TO YOUR LANOKA HARBOR STORE ONE MILE AWAY AND WAS IN AND OUT IN THREE MINUETS RUDENESS FREE. BAYVILLE DOSE'NT NEED A NASTY WELLS FARGO BANK AND NEITHER DO I.

Since I got the account with wells for a plumbing job. I never get a bill so from the beginning I’ve been late. It counties that I still don’t get a bill so I don’t know about late fees so I pay what I should be paying. Well they decided to call me at work as if I never pay them which I do EVERY month. I tell them about not getting bills they don’t do anything about it. Therefore now I owe them an extra 500 bucks in fees mm fuck that . Give me a bill. This company doesn’t care about their customers. Make things right

Bey Mehef P.O.A. for Mehef Bey

10926 Quality Drive Unit 30946

Charlotte ,North Carolina 28278

November 23, 2018

WELLS FARGO

Recipient Company Name

Recipient Address

Dear WELLS FARGO , Please accept my complaint regarding the conduct of several Wells Fargo employees for violations of Federal Law (listed Below)

In my attempt to open a trust account at the Wells Fargo Instutions at 712 Tyvola Rd, Charlotte, NC 28217, Wells Fargo, 2890 W Hwy 160 Fort Mill SC 29708 and Wells Fargo at 1500 Westinghouse Blvd Charlotte NC 28278 said they could not open the account because there wasn’t a manager avalailble to send the documents over to be reviewed and the will have a manager call me back the next business day witch would have been Nov 13 ,2018 but never received a call back.

In all attempts every item necessary to complete the transaction was provided but all persons involved kept insisting a social security number, when ask to verify with there head quarters the same results ,so in asking for a disclosure as to why they needed my social when a Federal EIN was provided no one could give me a disclosure.

At Wells Fargo in Fort Mill when ask to put in my social the key pad clearly stated T.I.N. number but was formatted as a social.

31 CFR 1020.220-Customer identification programs for banks, savings associations, credit unions, and certain non-Federally regulated banks.

(i)Customer information required -

(A)In general. The CIP must contain procedures for opening an account that specify the identifying information that will be obtained from each customer. Except as permitted by paragraphs (a)(2)(i)(B) and (C) of this section, the bank must obtain, at a minimum, the following information from the customer prior to opening an account:

(1) Name;

(2) Date of birth, for an individual;

(3) Address, which shall be:

(i) For an individual, a residential or business street address;

(ii) For an individual who does not have a residential or business street address, an Army Post Office (APO) or Fleet Post Office (FPO) box number, or the residential or business street address of next of kin or of another contact individual; or

(iii) For a person other than an individual (such as a corporation, partnership, or trust), a principal place of business, local office, or other physical location; and

(4) Identification number, which shall be:

(i) For a U.S. person, a taxpayer identification number; or

(ii) For a non-U.S. person, one or more of the following: A taxpayer identification number; passport number and country of issuance; alien identification card number; or number and country of issuance of any other government-issued document evidencing nationality or residence and bearing a photograph or similar safeguard.

42 U.S. Code § 408

(a) In general Whoever—

(A)willfully, knowingly, and with intent to deceive, uses a social security account number,

(8) discloses, uses, or compels the disclosure of the social security number of any person in violation of the laws of the United States;

None of the Federal was acknowledged by Wells Fargo and when asked who would I hold liable if the account was comprised no one had a answer ,please look into this matter and provide me with a remey so I can have faith in going to a Wells Fargo institution

Sincerely,

Bey Mehef P.O.A. for Mehef Bey

Ps Will be mailed to you also

Wells Fargo office in Conway on 4th Avenue - service is terrible at drive up there is one teller that works 4 lanes almost 10 minute wait everytime go there

I want my $600 back I had my lawyer look into the Charge off or set off and she said that what you guys did was illegal Wells Fargo took $600 from accounts that was not linked together and my account was not in the negative for 180 days

My dad had died about 8 months ago and he has a checking acct and there is about $5,000.00 in it and I am in charge of his will and I have been trying to close the acct. but the employees of the branch in az. they are giving me a real hard time about the whole thing and I do have a death cert. he lived in Florida of the time of his death and all I get is the run around I need to pay some bills of his that he had left first thing I was told that I need to go to Florida to close the acct. and I know that is one big lie so somebody needs to help me get access to his acct or I will go to the BBB and file a complaint and go to where ever I need to go to and put up a big stink I really hope that you can help me or ELSE!....thank you and have a nice day

I have held brokerage accounts at 4 different firms but had started consolidating in recent months. The account I maintained at Wells Fargo was over 55 years old. I had maintained it since I was 10 years old and had a broker here in Chicago.

About a month ago I was working with my 93 year old mother to close her account since it had a small balance and actually was costing her more than she was making-while she handles her own affairs I maintain a power of attorney.

Since her account was moved to the 800 number she called in. -

-I was present-When the person on the phone heard my voice she told my mother you have to call back without him there.

-We both told her I have her poa-she said I don"t care

-I then told her I am getting tired of the Wells Fargo crap-since they had required me to set up a seperate brokerage account in New York to handle my company RSUs.-SHE THEN TOLD ME SHE COULD SHUT THE CALL OFF ANYTIME SHE WANTS.

-I asked her to put her supervisor on-she then told me he would not get on the call.

After we ended the call I had my mother call back on her own. She sat on the phone 15 minutes-then you system disconnected.

My mother than called back the next day and lalked to 2 other individuals who closed the account-her money is now safely in a cd at bmo-harris bank.

As a result of CYNTHIA'S BEHAVIOR I RECENTLY CLOSED MY ACCOUNT AND MOVED ALL MY ACTIVITY TO AMERPSRISE-WHERE I AM RESPECTFULLY DEALT WITH. MY SISTERS HAVE ALSO CLOSED THEIR ACCOUNTS AT WELLS FARGO AS A RESULT.

I will tell you I did have some pleasent dealing with another call I had with a gentlemen when I set up my on line account. I also do understand the need to protect seniors. But I will not accept the rudness I experienced from Cynthia or anyone else I am paying to provide me a service. I also do not like the suspicous chain of events when my mother told her she wanted to close the account. I will never use Wells Fargo again.

i

-

Account# 0333986941

This has to be the worst process we had, this started with a lose of income, granted we never fell behind when this started, but we came to Wells Fargo for help once we knew what was happening. we started the process, after explaining our status, we had our loan explained and lowered then it when down hill. We when though 4 people and 3 loan processes, and found out last week that we are in worst shape than when this started. They took us though this process 3 times, and now we were told our Loan is higher after all the months of process, we been told our interest rate when up, and our payment had increased, it like they rewrote our loan, all that we needed was a short term decision until my wife got a new job. what we found was the worst process, and this has to be looked at by executives, I will be calling them about this issue along with the BBB along with the Consumer complaint division. this was just wrong!!! I can't believe we had 4 processes to get to this point. Is this how the process works.

Leo Williams

757 560-2316

The manager at Wells Fargo in North Main St., High Point, NC whose name is Gina A. (i don't remember her full last name but it starts with an A., was making eye contact with me to disapprove of what I think of my receiving financial disability from the government. She knows I am receiving disability from the computer screen at Wells Fargo Branch. When I confronted her with this complaint in the presence of my mother, she flat out denied it (in other words, lied). She and I and my mother got into a heated discussion of what I think was an insult to me and my mother. I am not going to bank at this bank in the future. The tellers at your Wells Fargo banks all ask me about my working status and i feel this is a personal matter (when I work, what my daily plans are, and what my medical diagnosis are). It's none of their business. I am very unhappy with your bank. You do not live by Courtesy sir.

Surya

Dear Sirs - Almost specifically a month ago (within a day or 2) I had an appointment in downtown Minneapolis at the Hennepin County Administration Building. I was told there I needed a copy of my bank statement (I should have remembered, but I inadvertently forgot). Fortunately it was pointed out there were 2 large Wells Fargo buildings, side to side on Washington Avenue, 2 blocks from where I was. Now as a relevant aside allow me to inform you I have a deformed leg (created by a doctor when I was 12) which causes me a great deal of pain increasing in gradation the more I walk. I made the painful stroll to the bank to obtain the simple, easily accomplished, bank statement. I talked to an Asian gal and showed her, by request, 4 different forms of I.D. however I do not have a drivers license. Her name was Pa (or so she claimed) and refused me said statement despite 4 ID's, and my offer to take my valid Visa card and use the PIN obviously known only to the holder of the account - ME! This, of course, she declined. This denial caused me a great deal of unnecessary time, pain from walking on my leg, and further effort the next day. I am using this venue to see what you plan to do. I am checking on small claims court. I don't know if I was treated so poorly because I am White and it has become quite vogue to treat Whites poorly. I have had a checking account for circa 10 years. Thank you.

Your Wells Fargo service manager at fashion square location had a retail customer ( the pantry) come in this week asking about a couple of team members. Sherry Turkey replies to her that The lead teller was fired for trying to steal money and The other service manager she left but between me and you I think she was stealing too she also added that the svm that left got surgery to get some enhancements done. All untrue!

This service manger should not be speaking negatively to customers about what goes on in Wells Fargo and definitely shouldn’t be giving her personal opinion about people she thinks was stealing. If this doesn’t cease immmediatly she will be hearing from an attorney and since she is your employee the company is as well. This is an awful look for the company a service manager telling merchants she doesn’t personally know that she thinks other team members were stealing.

We made a wire transfer to Wells Fargo bank from China with a mismatched beneficiary name and account number. Wells Fargo bank telexed our China bank informing us on this discrepancy and asking us what we wanted to do. China bank telexed back asking to cancel the transfer and refund the fund back to CHINA. 3 days later Wells Fargo Bank said the fund was "passed thru" to the account, inspite of the reported glaring discrepancy. We asked for refund and received total silence from Wells Fargo.

I mailed a check for $500 to Holly Hunter (469-951-6919) in Dallas to thank her for some assistance she had provided me. When she tried to cash it at the 1420 West Mockingbird Lane in Dallas, 75247, heavy Hispanic lady at drive thru teller would not cash it and called the police. They took Ms. Hunter's identification and branch manager George Gonzalez was abusive to her and they would not cash it because I had wrote "Thanks" in the subject line. After almost an hour they finally called me to verify the check. When Holly asked for an apology, they said she didn't deserve an apology. I have been a Well's Fargo client for over 30 years and this is no way to handle your customers. I am considering changing banks if you employ individuals who treat their customers like that. All they would have done was say hold on while we verify the check! You owe Holly Hunter an apology.

Darrell Davis - Account #8327398338

Approximately a month or more i had a disagreement with a Bank teller over a address change on my debit card and State id i gave the teller my address as i often do (this is the first time i had service from this teller.). I'm mostly served by teller Ms.Anna and i never had any problems with my cash advance request so i knew the problems existed with the teller whom was assisting me and my address change.as I've stated i gave the teller my address as i always do with Ms.Anna . for some reason my cash advance was denied and i was personally offend behind the fact the teller was not forthright in my card being denied i left and went to a atm in which my card was accepted i return to the bank and explain all this and i question her again hopeing she'd admit her mistake and she didn't over my address at this time words past and a manager steped in and the matter was closed.since then i have used the bank with out problems and teller Anna has service me and a clear record serach will verify my statement that since my mishap with the other teller I had been serviced by teller Anna.Therefore i don't understand her actions on or about 9/26/18 when i went to her window i was advised by teller Anna that the next teller could help me with my cash advance so i went to the next teller whom was pleasent and professional before my my business was over teller Anna came to me in front of the other teller and advised me she could no longer be of service to me over the disagreement i had with the other teller over a month or so ago and i stated this to as she walked off saying she didn't care.what confusing to me is why reopen a issue that old and resolved unless you're trying to create a incident or you've subcome to your personal prejudice towards a person of color.I believe her racist veiws gave her the opportunity to deny me service without due process and voilates my consittution rights to fairness and discrimination.I was not barred from the bank or pose a harm ful threat to anyone in I've other employees in disagreement and they've return to the bank and receive service without facing discrimination. I'm going to pursue my claim against teller Anna because i believe stronly....it was projudice and race related.yours turly, Vincent Allen

To corporate office and all customer service members of Wells fargo Bank:

Today 9/21/18 i have encountered a shocking and impossible thing that your bank cannot do for a customer service.

My payroll department where i work did a direct deposit to account which of 1,215.91$ the achtranaction but just sitting there, it did not or WF personnel did not transfer to my new account. I have tried several calls to several wells fargo customer service including the ach department.

My calls just went down to back and forth, then i went in to the branch where i opened my new account to seek their assistance so that i can with-

draw funds but still no one can transfer the amount to my open account.

I am the most frustrated human being possibly on this very moment of my life. There's just got to be a way to help me, after all the money is there!

Your system is not completely helpful. i have to wait till Monday even tuesday i am told.

My appeal, begging, calling, goin in branch 'NO HELP" I dont have money to live for three day??? im on medical leave during this time.

Is there anyone left in this institution that knows everything?????.

desperate customer,

Juliet Benin

9257871222/acct#7958791704

P.S. my employer is also wells fargo customer